Tips and Tricks to fix Negative Inventory Issues in QuickBooks Desktop:

While performing your accounting operations in QuickBooks, did you encounter the Negative Inventory issues? Don’t worry, you need to try the assorted convenient tips included in this article to get this technical error rooted out of your QuickBooks accounting software. We will cover the following aspects related to the Negative inventory issues in this blog post:

- An Overview of Negative Inventory

- Causes and implications of Negative Inventory on your company file

- Easy procedure to fix Negative Inventory issues

What is Negative Inventory? An Overview

You may encounter Negative Inventory issues in QuickBooks desktop, if you enter sales transactions before entering the corresponding purchase transactions. In other words, these issues erupt when you sell the inventory items that are not in stock with you.

When selling inventories that have been entered into the company file

- When using the Items Tab on the item receipt, invoice, check or credit card transaction, debiting item entry and crediting A/P, Cash or Credit Card Payable to purchase items.

- You do not sell more items on invoices or on sales receipts than you have on hand.

- The sales transactions register the Sales/Receivable transaction, debiting A/R and crediting Sales, and the Inventory/COGS transaction, crediting Inventory and debiting COGS.

- You run P&L and expense reports showing the invoices and sales receipts as they have records of both the income and the expenses.

- You run B/S reports showing item receipts, invoices, checks, and credit card charges because they record increases in inventory, and they show invoices and sales receipts because they record the decreases in inventory.

When you sell items that have NOT been entered into your company file

- The invoice keeps records of the Sales/Receivable transaction as expected.

- In terms of the Inventory/COGS transaction, QuickBooks accounting software by default considers that the average cost of the items not on hand is either equal to the items you had on hand or the Item Cost from the Item List.

- QuickBooks keeps records of the Inventory/COGS transaction through the assumed cost.

- If the next transaction or purchase is not at the cost assumed by QuickBooks, the purchase transaction must register an adjustment to Inventory and COGS to adjust the appropriate difference.

- Since the bill now affects COGS, it shows up on the P&L and other reports that show expenses.

Please remember that the Inventory/COGS transaction report does not appear on the transaction, but you can find it by running the Transaction Journal report. Also, invoices, checks, and credit card transactions with Inventory/COGS adjustments can be found on the Transaction Detail by Account and Account Quick Report for a Cost of Goods Sold (COGS) account.

Steps to identify Negative Inventory

Negative Inventory can appear on your Balance Sheet. However, it mostly shows on the following reports:

- Inventory Valuation Detail (IVD) report.

- Negative Item Listing Report.

Inventory Valuation Detail (IVD) report

This report is the one used to evaluate the level of your Negative Inventory. In the Quantity on Hand (QOH) column, the inventory (negative) shows negative numbers.

- Visit to the Reports menu.

- After that, choose Inventory followed by Inventory Valuation.

Negative Item Listing Report

You can use the Negative Item Listing Report in QuickBooks Enterprise 15.0 or later versions. Please note that this report shows the current negative quantities and doesn’t show the past negative quantities.

- Move to the Reports menu.

- Then select Inventory and then Negative Item Listing.

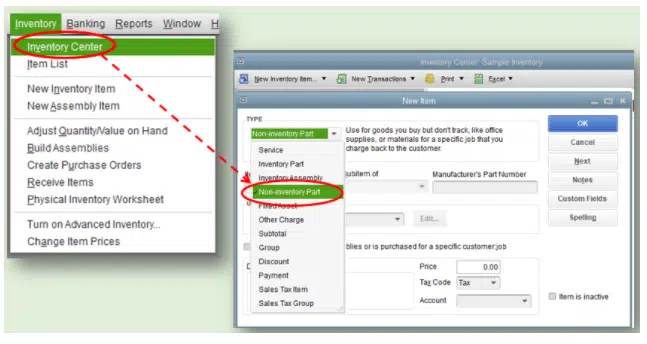

QuickBooks Premier or Enterprise 2014 or earlier users without Advanced Inventory can use Inventory Center.

- Go to the Vendors menu.

- Choose Inventory Activities followed by Inventory Center.

- On the top left of the Inventory Center window, change the filter from Active Inventory to Assembly to QOH <=Zero.

You might also see: How to Troubleshoot Unable to Print Problem in QuickBooks?

Easy procedure to fix Negative Inventory issues in QuickBooks

Before you start performing the troubleshooting steps that we are going to describe here, make sure that you create backup copies of your QuickBooks company file. Confirm with your accountant to be sure that the changes are legitimate and that you don’t have sufficient inventory to bring the current QOH to a positive value. Make sure that each occurrence of negative QOH is eliminated. In case the Negative Inventory is so extensive that you can’t repair it that easily, you can consider starting a data.

If sales are your first transaction(s) for an item

If you realize that your inventory reports have errors because you have not established an average cost, you can get them to show you the correct values by assuring that the earliest dated transaction for an item is not a sale but a bill, check, credit card charge or Adjust Qty/Value on Hand:

- Go to the QuickBooks Reports menu, select Inventory, followed by Inventory Valuation Summary.

- QuickZoom an item with incorrect values by double-clicking the item name, and the Inventory Valuation Detail report for the item will appear. The transactions related to this item are listed in order by date.

- QuickZoom the first Bill on the list to open the Enter Bills window.

- Make appropriate changes in the date on the bill to a date prior to the first invoice listed on the detail report you opened in the second step.

- Tap on Save & Close and record the bill with the new date.

- Now, perform Steps 2 through 5 again for each incorrect item.

You sold your inventory items and didn’t record the purchases

Perhaps you entered Bills with accounts and forgot the inventory items. If that’s the case, edit or change the entries from the Expenses Tab to the Item Tab. Remember, this step may alter your inventory expenses. You must consult your accountant before undertaking this process.

Purchases or adjustments were entered before entering sales

- If possible legitimately, alter the transaction dates and adjust them such that bills are dated before invoices:

- On the menu bar, opt for Reports, followed by Inventory, and then Inventory Valuation Detail.

- Choose the Dates drop-down arrow and click on All.

- Scroll through the report to an item displaying a negative amount in the On Hand column.

- If doable legitimately, adjust the bills dates and invoices to ensure that the bill dates are before the invoice dates.

- Repeat steps 2 to 4 for each item with a negative amount in the On Hand column.

Read Also: How to Fix QuickBooks Error 6000, 82 or 6000, 106?

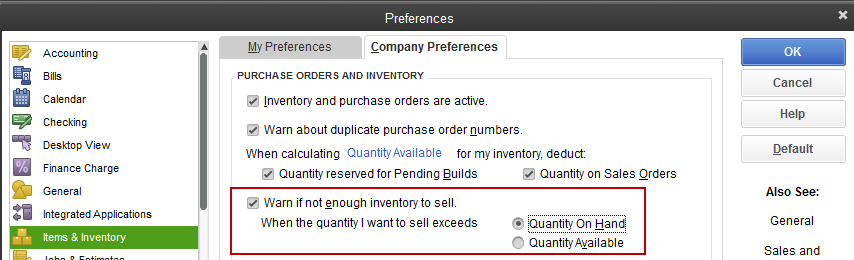

Tips to avoid Negative Inventory issues in QuickBooks

You can do a couple of things to make sure that this issue doesn’t reoccur. 1. Do not sell any inventory items until you have them with you and have entered them into QuickBooks.

Set up inventory items with an opening balance

- Create a fresh inventory item and put in the necessary information.

- Enter your QOH and Value at the bottom in order to establish an average cost.

- In case you have no units on hand, put in a purchase before entering a sale.

Use Sales Orders or Estimate to enter sales for the inventory that you lack

- Enter the Customer order in place of the Sales Order OR –

- Enter the Customer order as an Invoice and mark the Invoice as Pending (Edit > Mark Invoice as pending).

- Purchase the Inventory items and enter the purchase into your company data file.

- Convert the Sales Order to an Invoice or put the Invoice as final (Edit > Mark Invoice as Final).

Utilize Pending Invoices to enter sales for which you do have inventory

- Use the Customer order as an Invoice.

- Click on Edit on the menu bar and click Mark Invoice as Pending.

- Purchase the Inventory items and include them in your company data file.

- Tap on Edit in the menu bar and pick Mark Invoice as Final.

- Adjust the Invoice date to the date the goods are sent to the customer.

Problems Caused due to Negative Inventory Issues in QuickBooks

There is a long list of issues that may be incited due to negative inventory. Some major issues are enlisted in the following lines:

- There is no average cost for a new inventory.

- If you don’t mention an initial QOH/VOH while creating a new inventory item with an Item Cost, the item will be left without an average cost.

- The sale put the item into Negative Inventory.

- The invoice that has no average cost to credit inventory and debit COGS, uses the Item List for the Item Cost.

- You purchase the item for a cost that’s not the same as /2ent than the Item Cost.

- The bill consists of an adjustment to Inventory and COGS for the difference between the Item Cost and the real purchase cost, therefore resulting to show on the P&L report.

- The first transaction displayed to use the item was an invoice rather than a bill, check, credit card transaction or Adjust Qty/Value On Hand (IAD).

If you sell inventory that isn’t available with you drives your Quantity On Hand (QOH) negative and at times causes incorrect Cost of Goods Sold (COGS) on your P&L report.

- You include a new inventory item without an Item Cost.

- You sell that inventory item without purchasing any unit of that item.

- QuickBooks accounting software consists of no information offering to calculate the average cost thus it must use an average cost of $0.00.

- This cause often distorts your COGS and inventory.

- The issue may not be set right until you establish an average cost with a bill, check, credit card charge or Adjust Qty/Value On Hand.

Negative Inventory causes errors on vendor reports

You can generally find the Inventory/COGS transaction on the invoice. If you sell out-of-stock inventory, it may cause your next bill to contain an adjusting Inventory/COGS transaction. These adjustments are in connection with the vendor and appear on vendor reports.

Inventory Assemblies show incorrect COGS on job costing reports

If you sell more assembly items than you have with you, and later, when you create assembly items with a cost that isn’t same as the average cost, the build transaction will consist of an adjusting Inventory – COGS transaction, generally included in the invoice. The build transaction lets you enter either a customer: job name or a class to not include the adjusting transactions in the job costing and class reports.

In order to maintain inventory records that include COGS, it is imperative to keep inventory quantities from reaching a negative status. You can avoid selling out assembly items when you don’t have a sufficient quantity available. If you process a sale when the records with QuickBooks have not been updated with build information, make sure that you enter the build transaction before the sales transaction for correct reporting.

Read Also: Steps to Print W-2 in QuickBooks Desktop and Online with Adobe Reader

Final Lines

We hope now that after going through this writing, you should be successful in pursuit to fix negative inventory issues in the QuickBooks desktop. However, if the Negative Inventory issue still persists on your application, feel free to call our 24×7 QuickBooks enterprise support team via our helpline i.e., 1-800-761-1787 for more advanced solutions.

FAQ’s

Negative inventory-related issues pop up in QuickBooks Desktop when the quantity of items sold or used in transactions overtakes the available quantity, resulting in a negative quantity on hand.

Yes! Negative inventory can severely affect the accuracy of financial reports. It can result in the distortion of the valuation of inventory and affect the Cost Of Goods Sold (COGS).

Yes! The ‘Adjust Quantity/Value’ on Hand feature can be used for adjusting the inventory quantities and values.

More helpful articles: