Setting up a growing business is no easy work. It takes dedication, hard work, and a calm and composed mindset to kickstart a successful business enterprise. Once your business is up and running, the best way to keep it organized is by using automated software that helps you to deal with the various financial intricacies in a better and more convenient way. One of the most viable software to keep your business accounts organized is QuickBooks Online.

QuickBooks Online is quite extensively used in the business sector for the proper organization of financial statements and transactions. It is regarded as an accounting software similar to that an ERP solution. The software has many add-ons that make it very essential and benefit the users a lot. These add-ons allow the user to generate automated payrolls, CRMs, etc. QuickBooks Online software allows the user to record bank transactions with the help of feeds that the bank provides with its online banking factor.

This allows you to actively coordinated with your bank and be updated with every transaction in the business name. One such feature of QuickBooks Online is its ability to easily comprehend the payrolls and roll out the taxation process easily. QuickBooks Online coordinates with the revenue that has to be paid as taxes and allows the generation of W-2 forms very easily. In this article, we are going to discuss how to print W-2 forms with QuickBooks Online. So, keep reading it till the post.

You might also see: How to Export Reports as Excel Workbooks in QuickBooks Desktop?

What is a W-2 Tax Form?

Every earning citizen of any country has to pay an income tax annually; this amount works as a benefactor sum that the government takes from the citizens and then uses the sum to develop the state, and country. However, when you are an employee, you don’t need to worry about paying taxes, your employer deducts the amount from your paycheck and files your tax for you. Therefore, an employer needs to give a detailed account as to how much of the amount is being deducted from the employee’s wages as tax. This is where a W-2 form comes in.

A W-2 form provides you with a detailed account of the amount that has been deducted from an employee’s account on an annual basis, which is then used to file taxes. QuickBooks Online allows an employer to easily develop this form for their employees.

Why is it important to withhold tax?

If you are an employer, you have to deduct some of the amounts from your employee’s salary to file taxes. However, the sum that is deducted is transferred to the IRS at the end of every month. The employee is not always aware that his employer takes a certain sum from his paycheck and files his federal taxes every month.

Therefore, at the end of the year, when you are calculating the returns, the W-2 form helps you to calculate the accurate amount.

Why is it important to attach a W-2 tax form?

It is very important to attach a W-2 tax form to the payslip you pay to your employees at the end of the year. It allows you to keep in check the amount that has been assimilated as tax and differentiate it from the returns. Additionally, if you are an employee, the W-2 form will help you to understand the tax deductions that have been made from your salary slip. The W-2 form should always be attached to the salary slip paid at the end of the financial year.

Prerequisites for Printing W-2 Forms in QuickBooks Online

There are a number of prerequisites to note before you proceed with the printing of W-2 forms in QuickBooks online. These include:

- Make sure that your printer is working fine and that you have the printer driver set up correctly.

- Make sure that your subscription to the QuickBooks payroll is active.

- The black ink is mandated for printing W-2 forms in QuickBooks Online.

- It is necessitated that users have the latest tax table set up on the system.

- Users are required to double-check whether their QuickBooks Payroll version shows compatibility with the W-2 form.

Steps to Check the Subscription Status before Printing W2 forms in QuickBooks

Before users embark on the process to point W2 forms, it is pertinent to check the subscription status of QuickBooks Online. The steps to check the same is given as under:

- First and foremost, visit QuickBooks Online and sign in to your account.

- Following that, head to Settings.

- Herein, head to the Accounts and Settings option.

- Now, visit the option titled Billing Subscription and Payroll.

- Following that, click on the Plan details option.

- Within this option, the user will get all the relevant details regarding the subscription and the type of payroll plan owned.

- Check if you have the Basic or Enhanced plan of QuickBooks payroll.

- It is advised to have a full-service version of the payroll.

- When all is done, proceed with the subsequent section to print W2 forms in QuickBooks Online.

Read this also: Troubleshooting Issues while Reconciling in QuickBooks desktop

Steps to Print W-2 Forms with QuickBooks Online

Printing a W-2 form with QuickBooks Online is very easy and can be easily handled well. Therefore, let us go through all the steps to generate a W-2 form.

- Navigate to QuickBooks Online through the web browser.

- Go to the Payroll Tax Centre.

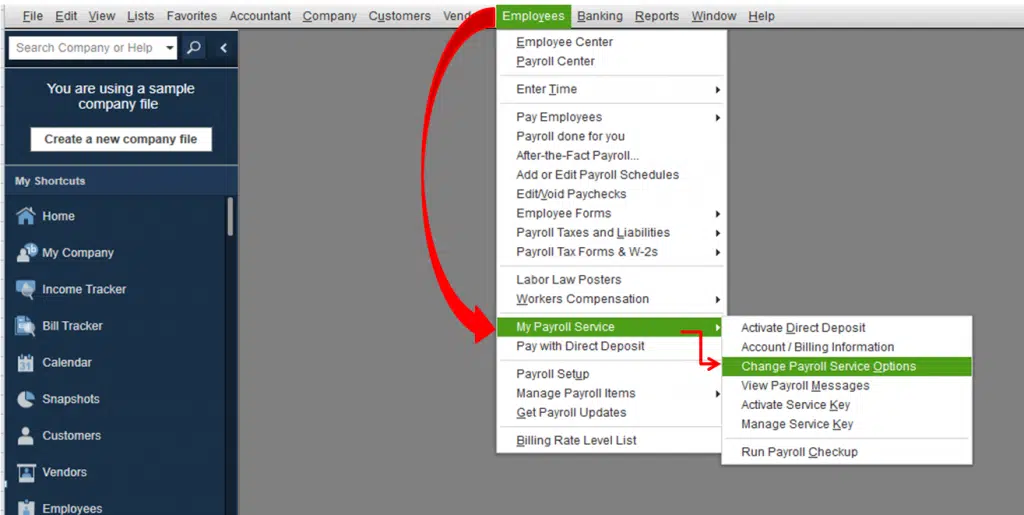

- Select the Employees option and then click on Payroll Centre.

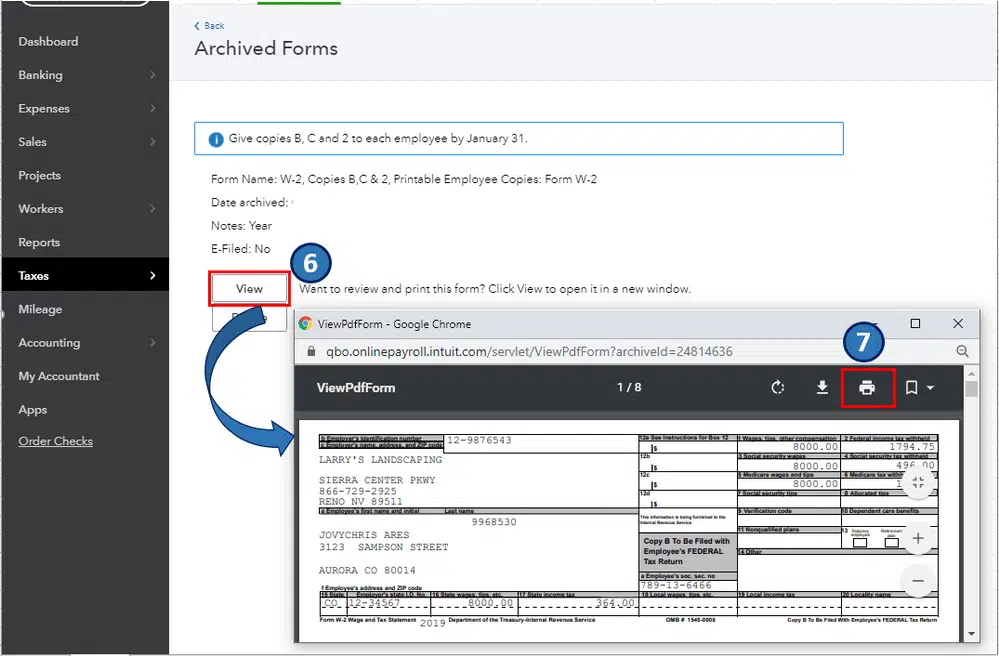

- Now go to the tab File Forms and select the View/Print Forms & W-2s option.

- Now, enter the payroll PIN.

- After this step, click on the next W-2 tab.

- A list of employee details will open in a dialogue box; select the employee’s name whose form has to be generated. Or, select all from the checkbox.

- Select Open/Save Selected.

- A Print Instructions page will appear, specify the reason for printing the form.

- A print dialogue box will appear, which will ask you to load the paper into the printer. It is very essential to provide your employees with instructions that they need to follow to file taxes. Therefore, it will be beneficial to load papers that have instructions printed on them for the ease of the employees.

- A detailed version of the file will open in a pdf file format. Go through the document carefully; if everything is correct, print the form.

- Lastly, go to File and then select the Print option.

Read Also: How to Troubleshoot QuickBooks Error 323?

Steps to Save and Print W2 Forms in Adobe Reader

Follow the steps mentioned below for saving and printing W2 forms in Adobe Reader:

Steps to Print W2 forms in Adobe Reader

- In the beginning, head to the Payroll Tax Center.

- Following that, move to Payroll Centre and then hit on the Employees menu.

- Click on the File Forms option.

- Subsequently, move to the View/Print Forms option.

- Following that, choose W2 and enter the correct Payroll PIN.

- Hit on Ok and then click on the option to View Employee W2 forms.

- Choose the Employee name and then proceed with the printing process.

- Use Adobe Reader to view the form.

- Within the Adobe Reader, hit on the File menu.

- After that, choose the Print option to print the W2 form.

Steps to Save W2 forms through Adobe Reader

- Within the Adobe Reader, click on the File menu.

- Following that, hit on the Save option.

- Opt for a desirable location to save the file and finally hit on Save.

Check Also: Ways to Fix QuickBooks Balance Sheet out of Balance Issue

Winding up!

It’s very convenient to print a W2 Form in QuickBooks Online. But, if you’re not a Pro at following instructions, then you could be stuck between. Therefore, if you encounter any type of problem, you can hire an expert who is knowledgeable about QBO. Just dial the toll-free phone number, i.e., 1-800-761-1787. A QuickBooks payroll technical support team will get in touch with you and will help you easily get your W-2 forms printed.

Frequently Asked Questions (FAQs)

A1. W2 forms contain all the critical financial information earned by the employees for a calendar period, including any perks and other financial remuneration. The information contained in these forms is used for the easy filing of federal taxes.

A2. Yes. QuickBooks emails your W2 forms both in the pressure-sealed format as well as the secure window envelope.

A3. Employees who ensure timely submission of their W2 forms have the leverage to certain benefits, including minimum pay, medical leaves, overtime, etc.

A4. W2 1099 form is issued by contractors for the reporting of their financial resources to the IRS.

A5. The steps to report W2 income in QuickBooks are as under:

1. Hit on the Gear icon and choose Taxes.

2. Then, click on the Tax Profile option.

3. Type in the net pay in Your annual W2 Income.

4. Finally, click on the Save tab.

Similar Articles:

How to Write Off Bad Debts in QuickBooks Desktop?

Steps to fix QuickBooks backup not working on Windows 10 problem

How to Disconnect Bank Feeds for an account in QuickBooks Desktop?