Table of Contents

ToggleLearn how you can fix Balance Sheet when it’s out of balance in QuickBooks Desktop:

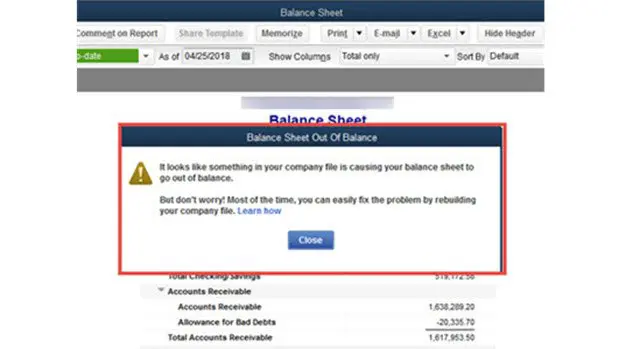

The reason why you are on this page is that perhaps you received the Balance Sheet out of Balance issue.

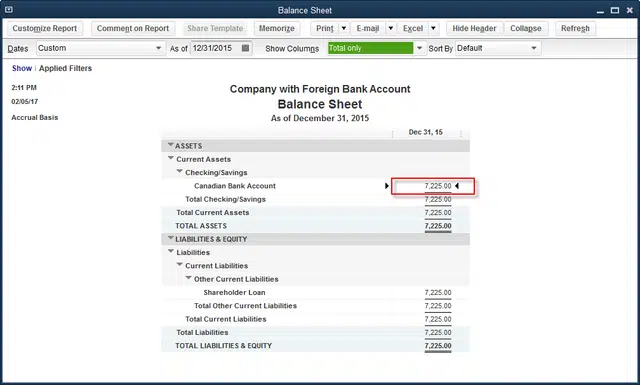

The process of balancing a balance sheet can be a hell lot annoying, especially when you aren’t able to spot what’s wrong with it. Balance sheet not tallying is one of the most commonly experienced error, and most annoying at the same time. You should always ensure the total number of assets and the amount of liability and equity in the QuickBooks balance sheet must always be the same. If the numbers are not in sync, you may receive the ‘Balance Sheet out of Balance issue in QuickBooks‘. Also, regardless of the changes in cash flow, on an accrual basis, QuickBooks records revenues and expenses as they happen, and in many cases, the reports may show variations in your balance sheet. But the good news is that there are some DIY solutions for you to fix this issue.

You can perform the solutions below, so as to chuck off QuickBooks balance sheet out of balance error with much ease.

- Fix basic data damage or corruptions.

- Find out and fix transactions causing Balance Sheet out of Balance in QuickBooks.

However, if in case you don’t want to manually rectify the balance sheet out of balance in QuickBooks problem, then in that case connecting with our tech personnel is highly recommended. You can get on a call with us using our helpline.

You can also read: How to Fix Reconcile Discrepancies in QuickBooks Desktop?

What is balance sheet out of balance problem?

Balance sheet is a statement of business-related data that consists of total assets and total liabilities. It is imperative for balance of asset side and liability side should tally otherwise, the balance sheet out of balance error may show up and stall your work in progress. This error basically means a contrast between the aggregates of assets and liabilities. There may be various reasons, behind this error that will be discussed later in this post.

Know when the balance sheet went out of balance

- At first, open your Reports and select Company and Financial.

- Go to Balance Sheet Summary and select Customize Report

- Now tap on the Display tab

- Set the Report Basis to Cash

- Make the changes in the columns as per the year/month/ week/day when the QuickBooks Balance Sheet out of Balance issue occurred.

If the QuickBooks trial balance out of balance issue still persists, please go with the article till the end and carry out the provided solutions in the right order. If you’re short of time or not comfortable in performing the steps provided in this segment, contact our 24X7 QuickBooks error support team and our certified accounting professionals will be happy to offer the best level of possible technical assistance.

Common issues leading to Balance sheet out of balance

Check if any particular type of transaction is putting the Balance Sheet out of balance. A few of the transactions that you need to look are as follows:

An inventory return and discount on an invoice

| Possible Scenario | Suggested Fix |

| Selling one or more inventory items | In this case, draft a new invoice for sale and the discount. |

| Customer returned one or more inventory items | This case requires drafting a credit memo for the inventory return. |

| A discount item | The discount item situation requires linking the credit memo to the invoice in receive payments. |

Unconventional inventory transactions

| Possible Scenario | Suggested Fix |

| 1. Transaction that adversely affect inventory such as: # Transaction that drive the Quantity on hand negative. # It change the Quantity on hand for previously entered assemblies and cause the assemblies to be marked pending. # Washing transactions with + and – units of the same item on the same price. # Transactions that use a damaged item, damaged customer, or vendor. 2. In case you are having a negative inventory that affects the Cash Basis Balance Sheet. You tired to do basic data damage troubleshooting on the company file. However, while entering inventory transactions again, the balance sheet becomes out of balance sheet becomes out of balance again. | 1. Correct transactions causing the balance sheet to be out of balance. The point to be noted here is that this might affect the financial statements for previous periods. 2. Begin with a new data file. In case the issue began after upgrading to newer version of QuickBooks, you can: # Reinstall the previous version. # After that, restore a backup created before upgrading. # Next, prepare the restored data file for upgrade. # Also, upgrade the data file again into the new version. 3. In case the transaction appears to be damaged, or is causing dis-balance without being one of the types of transactions that we have mentioned above, then in such a case you either needs to delete and recreate the transaction or else consult someone. |

Another transaction can be any discount that is entered at the customer level and then applied at the job level

| Possible Scenario | Suggested fix |

| * You are having a customer with several jobs. You completed all the jobs and invoiced the customer, which includes all the jobs on the invoice. * A payment is received by you for the invoice, but the customer included a discount for Job A in the payment. * User recorded the payment for the invoice and also entered the discount on the Discount/credit tab. | * In such cases, you are recommended to re-enter the payment and then split it among the various jobs, followed by entering the discount at the job level, in order to match it with the invoice. |

Journal Entry linked to a credit memo

| Possible Scenario | Suggested Fix |

| * You will have an open Credit Memo and then you entered an offsetting General Journal Entry (GJE), and then linked it to the Credit memo. | # In such a case, you will have to edit the Journal Entry. # And then, move the A/R account to the source line, which is generally the first line of the GJE. # You should save GJE and ensure that it is still linked to the Credit Memo. |

Related article: Fix QuickBooks is Unable to Send Emails due to Network Connection Failure Error

Points to Remember

There are certain points that you can’t afford to miss out before beginning with the process. Let us have a look:

- Modify the reported total by Year and then check if the balance sheet is back in balance.

- You can log out of QuickBooks file and then log back in, to check if the error is resolved.

- Also back up the QuickBooks company file before following any troubleshooting steps.

- In case you are working in a multi-user environment, this might cause damage to the company file, and the balance sheet might go out of balance. For resolving this, fix the data damage and use the main system from where the file is hosted.

- Now ensure to verify, rebuild and check the QBWIN logs before proceeding.

Quick fixation steps for QuickBooks trial balance out of balance issue

Before you start with the detailed methods to resolve balance sheet out of balance in QuickBooks issues, we recommend you to check out these basic troubleshooting steps.

- Modify the reported total by the year and then check if the balance sheet is back in balance.

- You need to log out the QuickBooks file and then log back in. Moreover, check if the balance sheet is back in balance.

- Along with that, back up the QuickBooks company file before carrying out any troubleshooting steps.

- If you are working in a multi-user environment, then it might end up in damage to the company file and the balance sheet might go out of balance. You can fix the data damage and use the main system from where the file is being hosted.

- You can verify and rebuild the QBWIN logs before proceeding.

Fixing your balance sheet when it’s out of balance in QuickBooks Desktop

The process to fix QuickBooks desktop trial balance out of balance involves multiple steps. Each of the steps carries its own significance. Thus, we will be discussing each of the steps in detail. Let us have a look:

Step 1: You can select the year by following the below-mentioned steps

- Expand options in the drop-down and Select All.

- Choose Year from the Display columns.

- Select OK button.

- Now compare the Total Assets and Total Liabilities to locate the year the balance sheet went out of balance.

You can select the month by following the below-mentioned steps:

- Put in the year your QuickBooks balance sheet went out of balance in the Form and the Field.

- Select the Right month from the display month and select the OK option.

- In order to find the month when the issue occurred, compare the entries – the Total Assets and Total Liabilities.

You can select the day by following the below-mentioned steps:

- Put in the week your QuickBooks balance sheet went out of balance in the Form and the Field.

- Next, select the day from the Display columns and click on OK button.

- To find the day on which the issue occurred, compare the Total Assets and Total Liabilities.

You may also like: How to Fix Error 80040408: Could not start QuickBooks?

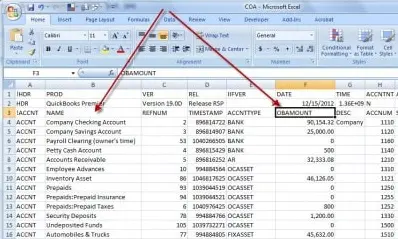

Step 2: Find the transaction responsible for QuickBooks Balance sheet out of balance

After you are aware of the date when the QuickBooks balance sheet out of balance issue occurred, move on to creating a Custom Transaction Detail Report to spot the transaction triggering the error.

- At first, go to Reports menu and select Custom Transaction Detail Report.

- After that, select Customize Report (in case the Modify Report window doesn’t pop up automatically).

- Next step is to tap on the Display Tab.

- And then go to Report Date Range and type in the date when the balance sheet was found out of balance issue occurred.

- Now set the report basis to Accrual.

- Under Columns section, uncheck the boxes before Account, Split, CLR, and Class.

- Check on the box before Amount and hit a click on OK button.

- This process will enable you spot the out of balance amount. That is the ending balance on this report.

Note: If you are unable to find the transaction that’s causing the error, you can run Customer Report, Vendor Report, Journal Report, and Other Transactions.

Filter by year

- The first step is to choose all from the Date drop-down menu.

- And then select the Year from the display columns and click OK tab.

- Followed by comparing the Total assets and liabilities to find the month the balance sheet goes out of balance.

Filter by Month

- You are is supposed to mention the year where the balance went out of balance, from the field.

- And then choose Month from the display columns, and hit OK.

- The final step is to compare the balance of Total liabilities and Total assets.

Now Filter by Week

- Enter the month in which balance sheet went out of balance.

- And then choose the week in the Display columns.

- Followed by clicking on OK tab.

- The final step is to compare the balance for finding the week where the balance sheet is mismatched.

Filter by Day

- Initially, Enter the week that showed the wrong balance.

- Select the Day from the display columns.

- Followed by tapping on OK tab.

- Now compare the balance of total assets and liabilities, to look for the day where the Balance sheet was out of balance.

Step 3: Check and manually fix specific data damage

Data damage causing balance sheet out of balance error may include the journal entries displaying amounts exclusive of the associated accounts, the balance sheet summary out of balance, difference in the column settings, and discrepancies in the cash and accrual balance sheets. These data issues can be fixed through manual troubleshooting.

Step 4: Re-date the transactions

- Once it detects the transaction causing the trouble, you require to change the date on them. Also, note their Current dates. After that, edit the Date on each of the transactions to a day 20 years in the future.

- Next step is to Save each of the transactions.

- And refresh the report, in case you are able to spot the Correct transaction. The paid amount column will then be Zero.

- Final step is to Locate the transactions that were dated into the future and then date them back to their actual date. It should be noted that the re-dating steps re-links the transactions and can easily repair them.

Step 5: Removing and re-entering the transactions

- In case changing the dates on the transactions doesn’t work, then you should Delete and Re-enter them.

See Also: Methods to troubleshoot QuickBooks error code h202

Conclusion!

We hope you find this article informative and helpful. Sometimes the QuickBooks balance sheet out of balance problem can be a little difficult and complicated, and you may not be able to fix it on your own. If that happens, contact our 24×7 QuickBooks support team using our technical line i.e., 1-800-761-1787. Our team of certified experts will solve the balance sheet out of balance issue at the earliest so that you can resume your work and meet your business goals.

Few other helpful articles:

Why is QuickBooks Unable to Calculate Payroll Taxes?