Last updated on February 4th, 2026

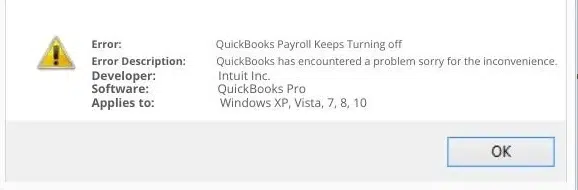

Using QuickBooks Payroll becomes a hassle when it turns off again and again due to certain technical glitches. Often when you try to work, QuickBooks payroll keeps turning off, or repeatedly shuts down, or stops functioning abruptly. Well, it is possible to deal with the error: QuickBooks payroll stops working and then switches off automatically.

You might see warning messages like:

- QuickBooks payroll connection error

- QuickBooks payroll network problem.

- Error: A problem causes the program to stop working correctly. The Windows will close the program and notify you if a solution is available.

In this segment, we are going to talk about how you can fix this payroll issue and what reasons can trigger such an error. Let us explore QuickBooks payroll keeps turning off issue in detail.

Table of Contents

ToggleWhy QuickBooks Payroll Keeps Turning Off Frequently?

Well, you can come across the payroll turning off issue in QuickBooks due to a handful of reasons such as:

- Network connectivity issues

- Damaged installation files

- Antivirus hindering the software communication

- Firewall blocking QuickBooks

- Payroll unable to connect to the internet

- Security certificate application is invalid

- Or if the system date and time settings are misconfigured.

You might read also: How to Use QuickBooks on Multiple Screens or in Multi-Monitor Mode?

Quick tips before you proceed with the fixation of QuickBooks payroll turn it off automatically

Here are some quick pointers that you need to keep a check on:

- Check for the date and time of your system

- Ensure that your security certificate is valid

- Make sure that you create a backup for your current company file

- Check the stability of the internet connection

- Turn off the antivirus program temporarily

- Ensure that your firewall isn’t blocking the application

Solutions to Fix QuickBooks Payroll Keeps Turning Off Automatically Problem

Now that you know what can land you into the QuickBooks payroll turning off the issue, here are the measures to fix the error successfully.

These steps are for Windows 7, Windows Vista, Windows 10, and Windows 8 users:

- Begin the process by closing QuickBooks and further create a back up of the company file.

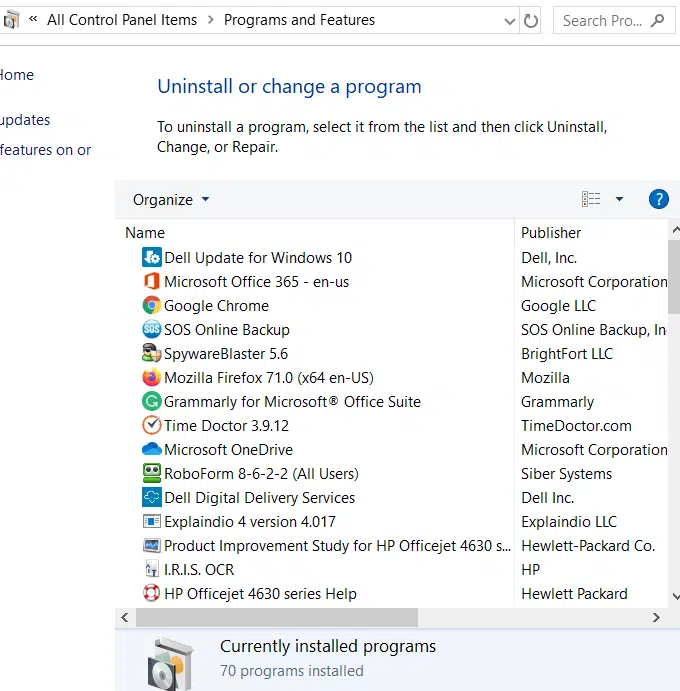

- Head to the start icon and choose the control panel.

- If you are a Windows 8 user, then you will see a variety of results when you search for the control panel.

- Now, look for programs and features option on the control panel screen.

- And then select uninstall a program.

- In case the above options are not visible, then head to programs and select the program feature tab.

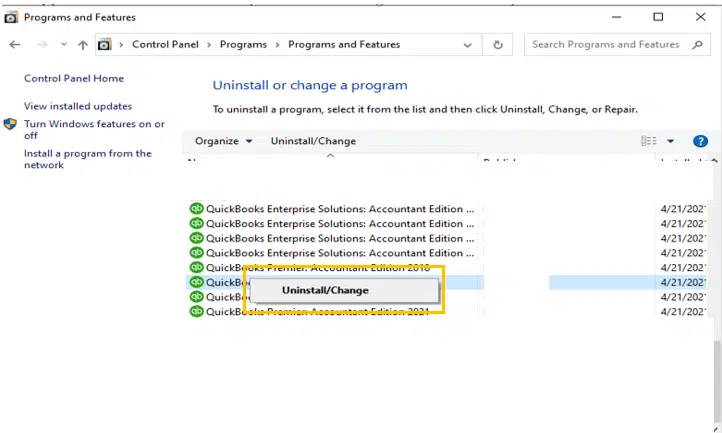

- You now have to look for QuickBooks from the given program list that is installed on the system.

- Furthermore, select the option to uninstall/change.

- And when you are asked to confirm the step, choose to continue and click on the next tab.

- By the end, you need to click on the finish tab and start the system again to complete the process.

What Next?

Did you see an error message when repairing: the QuickBooks file in use? If that is the case, continue with the steps below:

Step 1: Click on ignore and restart the system by clicking on the ok tab.

Step 2: You might have to click on ignore tab a number of times and after this is done, the repair process will begin.

Step 3: If you do not see the ignore tab, simply click on the close tab. After the repair is complete, the user is suggested to start the computer system again.

Read Also: Fix Error Message: “No new transactions” when importing web connect file in QuickBooks

Steps to Validate the Service Key of QuickBooks Payroll

Now that you have completed the process above, it is time to validate the service key of QuickBooks payroll. You will have to refresh it and authenticate the service key. Here are the steps you need to carry out:

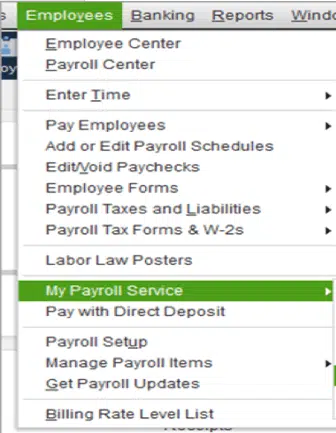

- Head to the employee section initially, once opening the particular QuickBooks payroll software.

- Select the option from the menu that shows My payroll service.

- Now, go for the opt termed as Manage Service Key.

- Find edit tab and click on the same.

- The next step is to choose the next tab and further click on finish to conclude the process.

After you are done with the entire set of steps, a message will show up stating: You have recovered the latest payroll update and also authenticated your payroll subscription.

Method to Activate Payroll in QuickBooks Desktop

If you don’t know how to activate payroll in QuickBooks, here is how you can do that:

Step 1: Get payroll subscription activated

When you purchase a payroll over the phone or online, usually a mail with a 16-digit service key is sent. After you access this key, enter in QuickBooks to use payroll. Moreover, check for junk or spam folders or use an automatic service key retrieval tool, in case you are unable to find the service key. Now, log in with your Intuit Account Credentials:

- Begin by opening the QuickBooks Desktop company file.

- Tap on the Employees tab and further the payroll option.

- Now, select Enter payroll service key.

- And also, go for add tab.

- You later have to enter the service key.

- And then, select the next tab and finish tab.

- Don’t forget to download the updated tax table.

In case you purchased your software from a retail store, then here are the steps you need to carry out:

- Start off by opening the QuickBooks company file.

- Head to the employees tab and then payroll.

- Once done with that, select Install Payroll from the box menu.

- Furthermore, you need to enter the payroll license on the payroll activation page and then the product information.

- You can find the information related to the license and product number on the yellow sticker of the CD folder.

- Hit the continue tab.

- And carry out the onscreen steps to complete the payroll activation including the service key.

Step 2: Complete the payroll setup tasks

- Enter any paychecks and tax payments made throughout the year, further enroll the employees, and set up the federal and state payroll taxes.

- This might take time.

- After that choose the employees tab and select payroll setup.

- In order to add employees, you simply have to set up your company’s payroll items and taxes, enter the pay history if required, and lastly perform the onscreen prompts.

Check also: How to Fix QuickBooks Desktop Keeps Crashing Issue?

Conclusion

You can only use your payroll features in QuickBooks when you eliminate the error successfully. Implementing the measures discussed in this piece of writing can help you do that. However, if unfortunately, the error still troubles you, in that case we can help you. You can discuss your queries and doubts with our certified ProAdvisors at 1-800-761-1787, and let them help you with quick fixes immediately. Our QuickBooks payroll support team have proven experience in dealing with all sorts of QB-related issues. For more details, ring us up right away!

Frequently Asked Questions (FAQs)

What are the ways in which a user can resolve the QuickBooks Payroll Errors?

Following are the solutions to resolve the Payroll Errors from QuickBooks:

1. First of all, a Digital Signature Certificate should be downloaded and installed.

2. The user need to proper check of the Internet Explorer settings.

3. Further, the user may also try to uninstalling the QuickBooks desktop related entries.

4. Last but not the least, the user can even try to Updating the Windows.

What are the reasons behind Payroll Service Server Error?

The QuickBooks payroll service server error occurs due to several reasons. These are as follows:

1) Check for the Security certificate. It may be invalid.

2) The user may be involved in transferring data in multi-user mode.

3) Incorrect settings of system date & time may lead to such problem to occur.

4) Also, incorrect configuration of Internet security and firewall settings may result in the trouble.

What are the causes behind QuickBooks Payroll discrepancy?

There might be several reasons as to why the QuickBooks Payroll discrepancy occurs. Some of the reasons are as follows:

1) There might be some problem within the installation files.

2) Another cause might be if the security certificate is not valid for QuickBooks.

3) QuickBooks Application is having trouble connecting to the server may also lead to such errors.

Recommended to read:

How to Fix QuickBooks Error Code WLT1003?

Fix Error 15240: The payroll update did not complete successfully