Learn what’s new and improved in QuickBooks Desktop Mac Plus:

Are you a QuickBooks Desktop for Mac user? If yes, then this article will be of much help to you as it will apprise you of the new features that come along with QuickBooks Mac Plus 2022. Today, we will be talking about these new and improved features of QuickBooks Desktop for Mac. The QuickBooks desktop for Mac has come up with its 2022 release that comes with new features and functionalities that aim at simplifying the process of accounting and bookkeeping and ultimately enhancing the productivity of your business. QuickBooks Desktop Mac Plus 2022 has come up with some enhanced features to make receiving payments easier and also boost the cash flow. The latest release puts the most important information and insights at small business fingertips. The streamlined experience gives its users quick access to the important aspects and also assists in completing tasks more quickly and easily.

If you are interested in knowing these features and functionalities of QuickBooks desktop for Mac 2022 release, then make sure that you read this segment carefully till the end. Or you can also talk to our U.S. based accounting professionals and ask them the new features and functionalities of QuickBooks desktop for Mac. Call us using our dedicated customer support line 1-800-761-1787, and get instant assistance from technocrats.

You may also like: How to Resolve QuickBooks Error Code 12157?

Table of Contents

ToggleNew and Improved Features of QuickBooks Desktop Mac Plus 2022

As we mentioned earlier, there are various new and improved features of QuickBooks Desktop Mac Plus 2022. Let us check out each of the feature one by one:

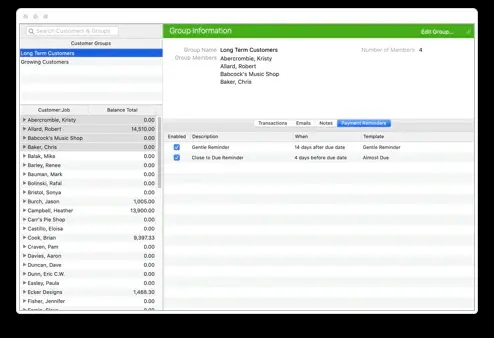

Automated Payment Reminders

With the new QuickBooks Desktop 2021, you can easily set reminders for customers when their invoices are due. This particular feature is designed in a way to save you from the manual task of following up on overdue invoices by automating the process of sending the payments due reminder emails. You can easily schedule payment reminders along with configuring the way you want the reminder emails to read video.

Here’s how to create a payment reminder:

- Move to the Customers tab, and then click on payment reminders. Also, select Schedule payment reminders.

- Go for the (+) icon from the customer center, and then give the group a name.

- Pick the customers you would like to add to the group from the customer: job panel.

- Choose OK tab, when you are done with adding customers to the group.

- Select the customer group from the customer center, select the payment reminders tab.

- Head to the gear icon and then choose new payment reminder.

- Last but not the least, customize the reminder description, reminder date, and any other information and hit OK tab.

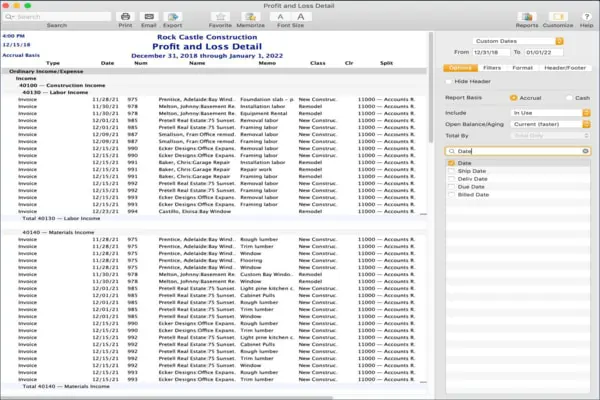

Modernize Reporting

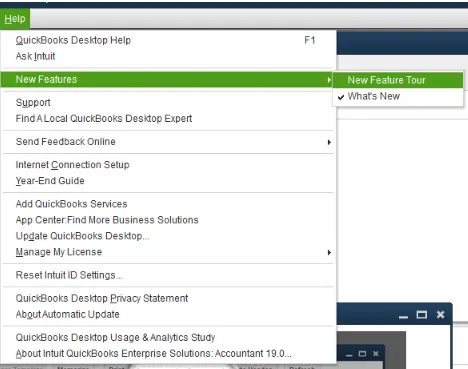

The modernize reporting feature helps in customizing, usability, presentation, and navigation. This feature allows to easily create customized reports and also enables real-time report updates that show changes automatically. You are required to follow in the what’s new window, when you first launch QuickBooks for Mac or from the help > what’s new in QuickBooks? Menu.

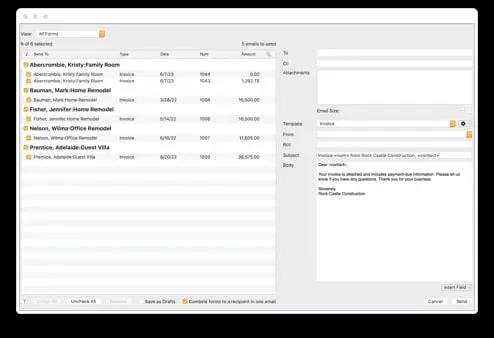

In the reporting sidebar, you will get three tabs, i.e. options, filters, and format. This gives reporting more advanced features, streamline the process of creating a report design that fits for the requirements. Steps to combine multiple emails:

- Select email forms from the file menu. These are all of the forms you have selected to email at a later time.

- Go for the forms you wish to send.

- Tick mark the checkbox for combine forms to a recipient in one email.

- Choose send, when you are done.

Read Also: Steps to Fix Web Connect Import Errors in QuickBooks Easily

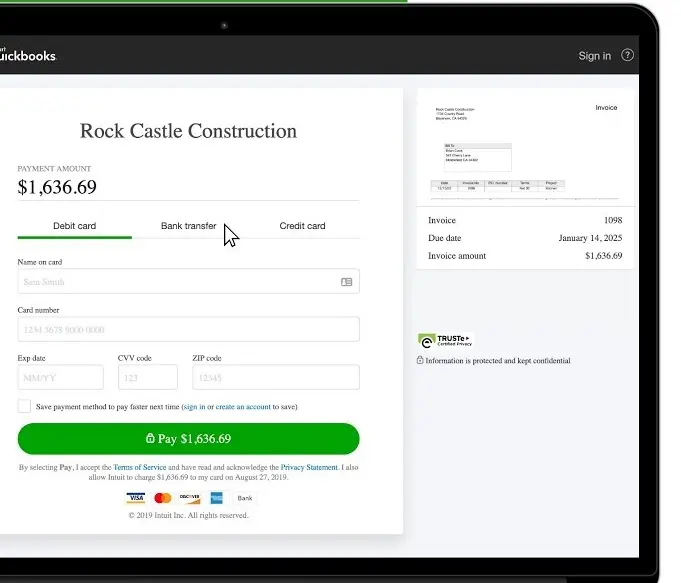

Invoice e-payments

With this latest feature, you will be able to enjoy the facility to send customers online invoices using a credit card, e-payment options. Also, accepting ACH, credit cards, e-payments for payment, you can save your time and get paid faster, as there is no need to make manually record and process payments.

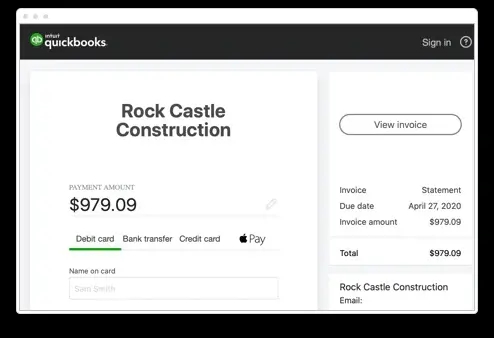

Statement E-payments

You can now send statement with payment links that encourage customers to immediately settle your business via an online payment portal.

How to use e-statements:

- Head to the customers menu and then choose create statements.

- Pick the statement dates and customers, and choose option to allow online payments.

- When you are ready to send these statements to the customers, then select email.

QuickBooks software creates a pay online link in the body of the email. And also selecting this link takes the customer to a secure online payment portal, where you can input their banking information, debit card, or credit card.

In order to record payments and deposits, the steps below can be followed:

- Go for the customers menu and choose record merchant service deposits.

- Choose the transactions and also opt for record.

You may also see: Which Versions of Windows 10 are Supported with QuickBooks Desktop?

Hassle-free process to combine invoice emails

Another feature that rolled in with QuickBooks Desktop Mac Plus 2022 is the combine invoice emails feature. Now, you can receive quicker payments by enabling customers to receive multiple invoices in just one easy to process email. You can transmit all of the customer’s invoices to them attached to a single email without having to manually combine them outside of QuickBooks Mac. This feature will save a lot of time, and customers will over the fact that they no longer must open one email after another.

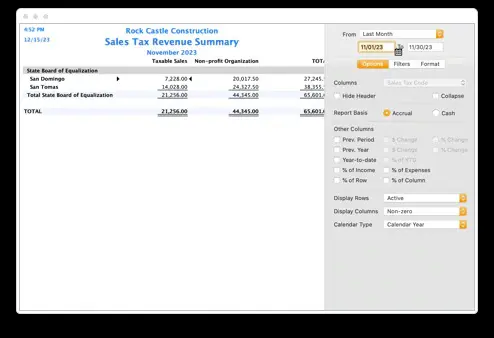

Sales Tax Codes

You can record transactions using specific sales tax codes for out of state orders, multiple districts, and non-profit organizations. And also can easily spot all the sales tax liabilities by specific sales tax codes on the sales tax revenue summary.

The steps for setting up sales tax codes are discussed below:

- Head towards the lists menu and choose sales tax codes.

- Pick the add (+) for opening the New sales tax code window.

- Enter the code in the code field. Below are some common sales tax codes examples:

- OOS for out-of-state sales

- LBR for labor services

- NPO for non-profit organizations

- GOV for sales to government offices

- WHL for wholesalers

- RSL for resellers

- In case the sales tax code that you are creating is taxable, select the checkbox next to taxable. In case it is not taxable, then leave the checkbox clear.

- Add a description for the sales tax code, and then select next, if you have another sales tax code to add.

- Tap on the OK tab.

Also see: Setup and Configure Email Services in QuickBooks desktop

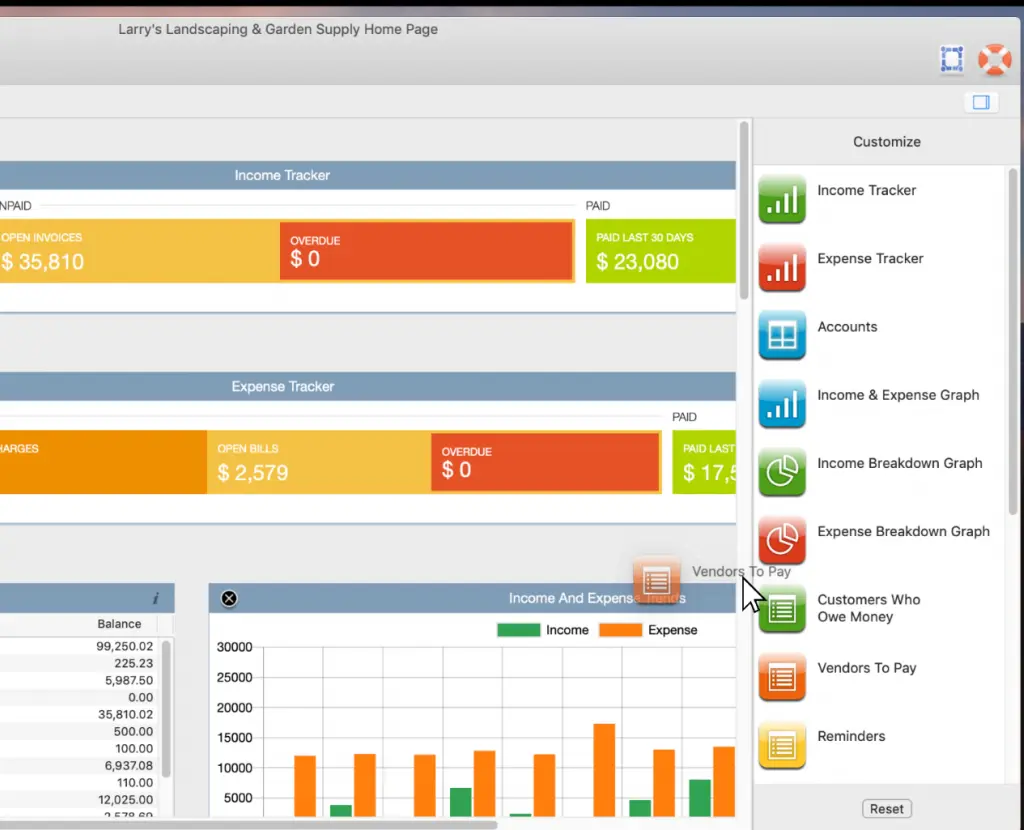

Enhanced Company Snapshot

Using a centralized dashboard, you can get hands on customizable date ranges, layouts, and widgets, to get more visibility into the business and help in seeing the business data. With the help of the improved snapshot, you can get great detectable quality regarding the business with a customized dashboard, along with adjustable information extents, formats, and gadgets.

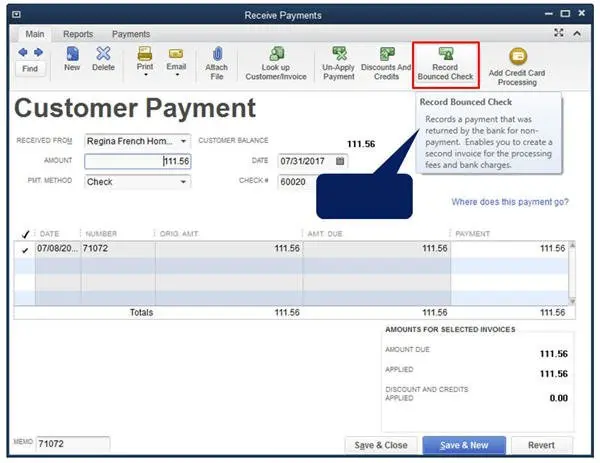

Processing of Bounced Checks

The newly introduced feature of bounced check processing, allows you to easily process to bounced checks. This saves the money, as you need not to pay accounts to correct the incorrect recorded bounced checks. In case there is any issue in the check received from the customer, and already deposited the check into the account, this feature will help in easily recording it and charging the customer a fee, only if you want.

Also Read: Latest DIY methods to Remove QuickBooks Error code 30114

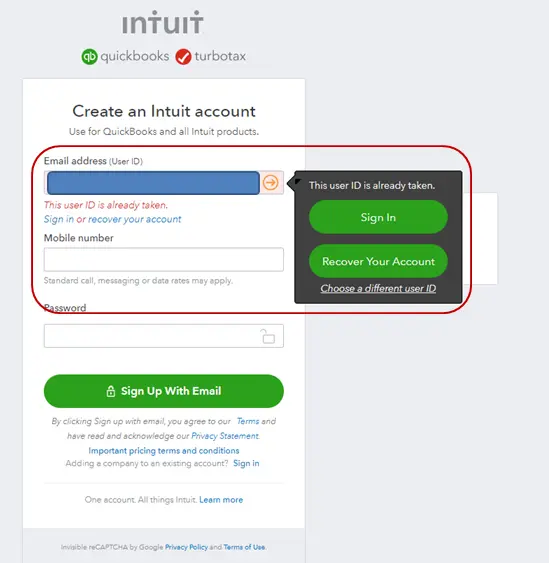

One Intuit ID

Intuit One ID is a new feature that is used to link the Intuit account ID to the company file. After you upgrade the company file to the 2022 version, you will be able to log in using the Intuit account. This will make it easier for you to manage the account, and view the customer purchase history, and also use services like Payroll, Merchant Services, e-invoicing and more….

In order to manage the Intuit account:

- Start with simply heading to the QuickBooks menu and select preferences.

- Pick the Intuit account icon.

- Opting for the sign-in tab is recommended, and then log in to the Intuit account if you are not already.

- After you have signed in, select Manage your account. You will be taken to the Intuit QuickBooks website, where you can manage the products and or services.

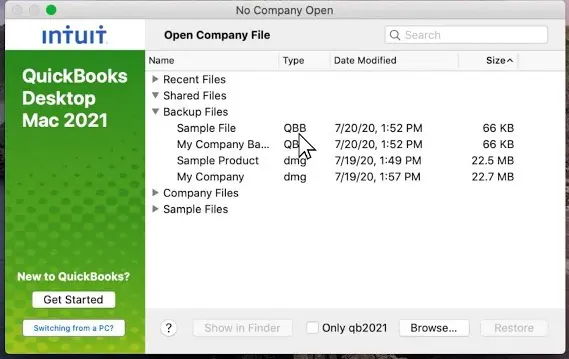

Restoring Backup Workflow

You can simply restore QuickBooks files quickly with a simple-to-use backup file restore wizard. A few QuickBooks Mac users have reported that the process to restore backup was too cumbersome, so with the new feature of the restore backup wizard is intended to streamline the process. Once you open QuickBooks, you will be able to restore the backup file from the No Company open screen. This can be done as follows:

- Start off with opening QuickBooks Desktop Mac Plus 2022.

- From the No Company Open screen, select the backup file you would like to restore.

- Pick the Restore and review the company file information and attachment library that will be restored, and choose the Continue tab.

- QuickBooks will offer you an option to review and/or change the name and location of the files.

- Tap on the save tab, and you are good to go.

QuickBooks restores the company file and re-associates the attachment library, if included one. After the backup is done, you can log in to QuickBooks.

Customized Charts of Accounts

The QuickBooks accounting software will create a chart of accounts, on the base of industry selection. In order to track the income and expenses, and also you can remove the accounts that aren’t in much use.

Also Read: How to Resolve QuickBooks Error Code 6190 and 816?

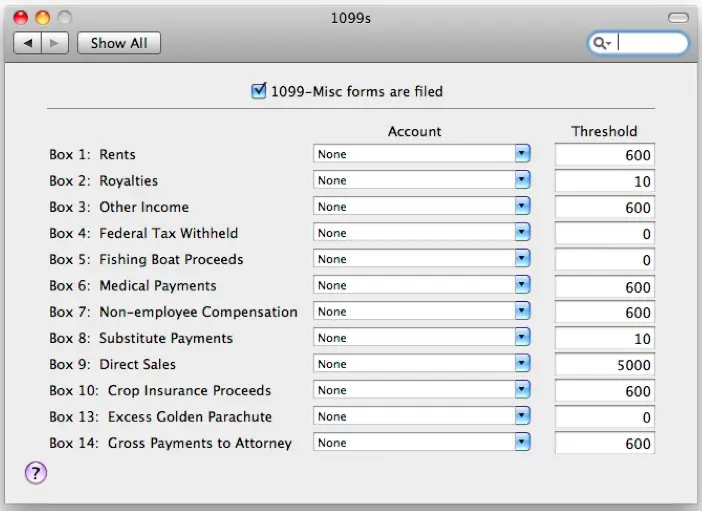

1099 Tracking

Another great feature that rolled in with this release, was tracking payment for particular contractors in QuickBooks for Mac at the end of the year. You can generate the information required to provide the form 1099 and reports must be provided to the contractors and local tax authority.

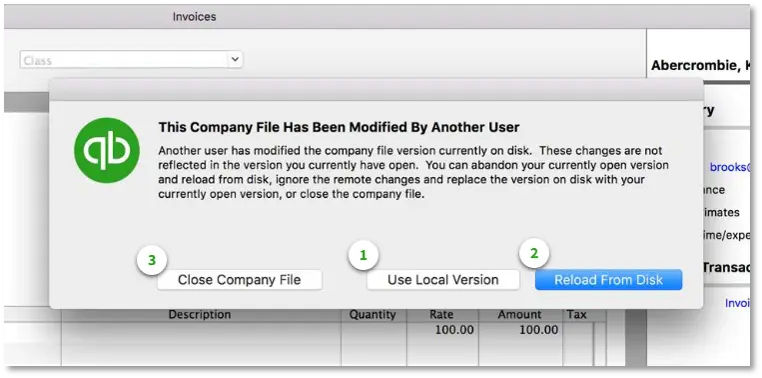

iCloud Document Sharing

The iCloud document sharing feature helps in sharing the data from one Mac to another. You can also share the data in multiple systems using this particular feature.

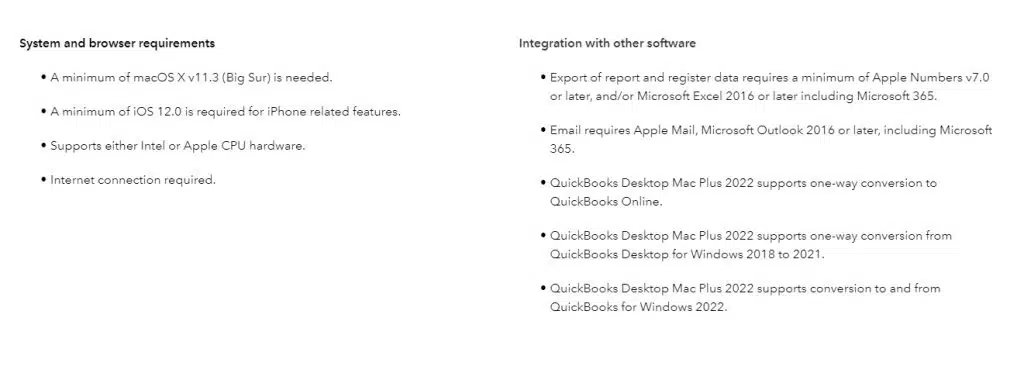

System Requirements of QuickBooks Desktop Mac Plus 2022

To run the QuickBooks Desktop Mac Plus 2022 on your system, you have the following system requirements:

Related Article: How to fix QuickBooks Payroll Error 2107?

A Final Note..!

We conclude the segment over here with the hope that the information shared in above and the features mentioned in this piece of information, would be enough for you to understand the QuickBooks Desktop Mac Plus 2022. In case of any query, or for any further assistance, you can call us by means of our support line i.e. 1-800-761-1787. Our QuickBooks Desktop Support experts and U.S. based and Intuit-certified professionals will be there to help you.

FAQ’s

Does Desktop Mac Plus 2022 support multi-user access?

Yes! Mac Plus 2022 does support multi-user access. Users have the freedom to set up multiple users using different access levels and permissions for operating the financial data.

Can I import data from other accounting software into QuickBooks Desktop Mac Plus 2022?

QuickBooks Desktop Mac Plus 2022 is rolled out with multiple options for allowing the importing of data from other accounting programs. The list of data that can be imported subsumes the customers, products, vendors, and services.

Can I access QuickBooks Mac Plus 2022 remotely or on mobile devices?

No! QB Mac Plus 2022 is only designed to run on Mac computers. It does not have built-in remote access or mobile app capabilities.

Similar Articles:

How to Crack QuickBooks Admin Password?

Fix Outlook is Missing in Send Forms Preferences in QuickBooks Desktop

How to Fix Error: QuickBooks Desktop is Unable to Send Your Emails to Outlook?