Error codes ‘00000 XXXXX’ generally encounters during payroll setup and it restrict the completion of the payroll set up and may prevent payroll updates, employee data entry, or tax form downloads. Generally, these errors are caused when the name of a file in the Vendor or Employee Center, or on the timesheet, includes a particular character, or if there is duplicate entries for the employee’s name.

If you are facing this error, then this segment will provide a detailed guide about QuickBooks error codes 00000 XXXXX in payroll setup. Later on this segment will assist you towards resolving these error codes and the related problems associated with them. It is important to note the general format of such errors is ‘00000 XXXXX’ and there is an error code associated with each format ranging from ‘00000 00001’ to ‘00000 99999’. As this error of QuickBooks is also known as Unrecoverable Error so it is recommended to fix this as soon as possible to prevent any data loss.

Table of Contents

ToggleAll about QuickBooks payroll setup error code (00000 XXXXX)

The QuickBooks Payroll Setup error code can range from 00000 00001 to 00000 99999. These clusters of errors can put restrictions in payroll setups and may lead to other issues which seem irresolvable. It usually encounters because the name of the company file in the vendor or employee center has a duplicate file of it or the name has a character in it. It may also occur due to some kind of special character in the company file.

What are the Different types of Payroll Setup Error or Unrecoverable Errors?

When Payroll setup error occurs in QuickBooks desktop, it blocks the setup wizard of payroll in the QuickBooks desktop payroll program from being opened. Also, in case you are trying to access the Payroll Setup Wizard within QuickBooks desktop payroll, and you see an error message that has an error code that reads: “00000 XXXXXX“, don’t be worried. We’ll help you identify the root of the problem and get it resolved. A few error codes 00000 XXXXX in payroll setup are listed by users as:

| 00002 71328 | 00000 38049 | 00000 97340 |

| 00002 20123 | 00000 88579 | 00000 88703 |

| 00000 17002 | 00000 38772 | 00000 40370 |

Additional errors you may see:

| 00000 99867 | 00000 88703 | 00000 34289 |

What leads to ‘00000 XXXXX’ Error codes in payroll setup?

Error codes of the format ‘00000 XXXXX’ occur due to the following causes:

- There is some special characters in the file name on the vendor list or the employee Centre.

- Incomplete Payroll Setup.

- Some special characters in the filename of the timesheet.

- Some duplicate entry of an employee name has been identified.

- There is compatibility issues with payroll updates.

- Entering invalid or mismatched federal/state tax ID numbers (like EIN) may also cause payroll validation errors.

How can QuickBooks payroll setup error code format 00000 XXXXX be fixed?

Since you are now familiar with the causes that trigger the QuickBooks payroll setup error codes, let us now acquaint you with the methods needed to resolve the error and the problems which come along with it. Here is a some DIY methods to resolve QuickBooks desktop payroll setup error code format 00000 XXXXX:

Condition 1: When the Payroll setup error code 00000 XXXXX appears on the screen

- First of all, when the error message gets displayed on the screen, the you need to click on the View Report Link from the error window.

- This will open a new window. The window will open a partial window of the failure that has occurred.

- Next, find the file ReportHeader.xml.

- Then, you need to use Windows Explorer to go to the location of the file ReportHeader.xml.

- Right-click on the file and select ‘Open with’ to open the file. Do it on a New Window on Internet Explorer.

- Then press ‘Ctrl + F’ keys to open the search box. And look for ‘Exception String 0’.

- The statement following ‘Exception String 0’ in the report provides details about the origin of the error.

- Go for the necessary changes to solve QB Payroll setup error. For Example:

<Name>Exception String 0</Name> <Value>System.Exception: exception thrown in background thread —> System.ArgumentException: Item has already been added. Key in dictionary: ‘(unnamed employee)’ Key being added: ‘(unnamed employee)’ at System.Collections.SortedList.Add(Object key, Object value)

Condition 2: Fix the following error messages:

Error 1: When Item has already been added. Key in dictionary: “[Vendor or payroll item name]” Key being added

Solution

If the Exception String 0 Statement displays that the item has already been added, then you are required to follow the below-mentioned procedure.

- From top menu bar at top, you need to select ‘Vendors’.

- Next, select Vendor center. You can also select Items.

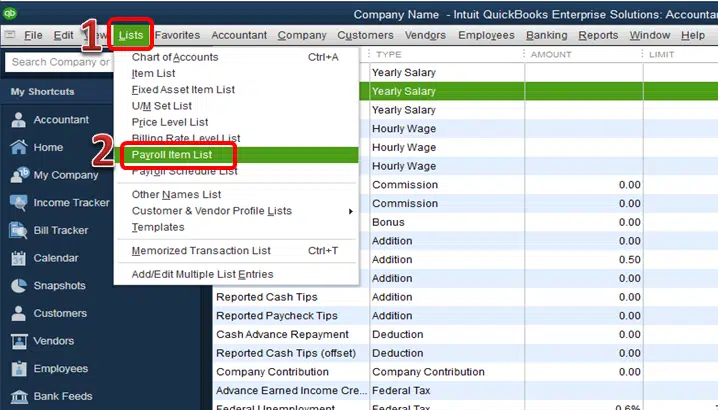

- After that, you have to search for the Payroll item list.

- Next, you need to Identify the vendor that causes the error. The same vendor is enlisted twice.

- Then, you have to opt for Show inactive. Selecting this option will show any potential duplicate items.

- At last, rename one of the duplicate files with a unique name.

Error 2: If the Item has already been added. Key in dictionary: ‘(unnamed employee)’ Key being added

Solution

In case there exists a duplicate name of the employee, you are required to remove the same in the Employee Center.

- From the top menu, you need to go to Employees tab.

- Then, go to the Employee center.

- After that, from the list that appears on the screen, select All Employees. (Note that this shall include inactive employees)

- Right-click on the Duplicate names and select on ‘Delete Employee’.

- If you are unable to Delete the duplicate employee because of transactions in the current payroll, you can move the transaction to the list of primary employees.

- After that, try to delete the duplicate employee once more time.

- If there is no payroll transaction on the account of an employee, then time card data might be damaged or corrupted.

- Navigate to Employees and then Entry Time and look for entries that contain ODD or INVALID characters.

Error 3: Item has already been added. Key in dictionary: ‘(unnamed employee)’ ‘the specified special account already exists’

Solution

To remove unnecessary blank spaces, follow the below-mentioned steps:

- At first, from the Menu, select the Employees option.

- Next, click on Employee center.

- From the view drop-down list select All Employees. This will include inactive employees.

- Next, you need to remove the unwanted spaces.

- At last, you have to manually enter the First and Last name.

Error 4: The storage category map is invalid for the Local tax payroll item

Solution

If you encounter an error message stating ‘Storage map being invalid for the Local tax payroll item’, you can fix the error as follows:

Step 1: First of all, you have to create an Employee Withholding Report. To create this, the user must follow the following steps:

- For this, click on Employees & Payroll and then select Employee Withholding..

- Next, click on Customize Report option from columns.

- After that, from under the Columns tab, remove the check marks from the items in the current list. Check Marks should be placed near Employee, Local Tax 1, Local Tax 2, Local Tax 3, Local Tax 4, Local Tax 5, Local Tax 6, Local Tax 7, Local Tax 8, Local Tax 9, Local Tax 10, Local Tax 11, Local Tax 12.

- Now visit the ‘Filters’ tab and click on the Active status.

- Select All and click OK.

- Click ‘OK’

- At last, you need to leave the report open, print or select Excel and then create a new worksheet on it.

Step 2: Create a Payroll Item Listing Report

- To make a Payroll Item Listing Report, follow the procedure mentioned below:

- Navigate to ‘Reports’.

- From there, you need to navigate to Employees & Payroll and then move to Item Payroll Listing.

- Now click on Customize Report.

- Remove the checkmarks from all the listings except from that of the Payroll item and Type of Payroll.

- Next, click on the Active Status.

- Then, select All.

- Select the ‘Filters’ tab, and click on ‘OK’.

- Keeping the report open, print or click ‘Excel’ and click on ‘Create New Worksheet’ to export the same to the Excel tab.

Step 3: You have to compare the two reports and find Local Taxes which are not of the Other type.

Step 4: It is necessary that you edit each employee with an item of tax which is not of type ‘Other’.

- For this, first of all, to open the Edit Employee window, you have to double-click the employee from the Employee Withholding Report.

- Next, you need to click on Payroll info tab.

- After that, click on the Taxes button.

- From Other tab, you need to remove the tax item which does not have a type Other.

- Lastly, you have to click on OK twice to save the changes which have been made.

Step 5: You should run the Payroll Setup all over again. And check the error is fixed or not

Error 5: System.IO.FileNotFoundException: Could not load file or assembly…

You need to try to repair the QuickBooks desktop, if the company file which is inside the QuickBooks is corrupted or damaged. If the process is devoid of proper functioning, then you will need to proper clean installation of QuickBooks in a selective startup.

Error 6: Unexpected value. The value is devoid of falling within the expected range.

This QuickBooks error occurs with a code: QuickBooks Payroll error 00000 99867. This error often signifies that the employee is devoid of any kind of state configuration in their profile. You can attempt a search of the missing employee and then try fixing it. Following are the steps that you need to follow to do this:

- At first, go to Employees and then choose Employee Center.

- After that, right-click anywhere on the Employee list and select the Customize column option.

- Select the State lived and state lived in the available columns list.

- After that, choose the State Worked column and then click on OK.

- Then, you need to double-click on the Employee who is not present in the state.

- Moving on to the next step, select the Payroll information.

- Next, you need to click ok Taxes.

- Lastly go to the State tab, and then select the Correct state.

QuickBooks Error 00000 88703: This means that the first and last name fields are not filled out on at least one profile of employees. The names of employees will appear within the Employee List, in the normal way; however, you’ll need to go through each profile of the employee.

Change employee names:

- Firstly, choose Employees and then hit a click on Employee Center.

- In on the View drop-down menu, choose “All Employees” to include inactive employees.

- View each employee’s profile to look over the employee’s First and last name fields.

- Enter a First and a last name in case they’re not there and only appear in the Print on check as field.

If the error code isn’t associated with a specific code, this means a payroll item has a missing or unexpected amount. Make use of Payroll Checkup to identify and change the amount that doesn’t fall within the expected range.

FAQs

What do the QuickBooks Error Codes 00000 XXXXX in the payroll setup mean?

The Error Codes 00000 XXXXX in payroll setup usually indicates an issue with the payroll setup or configuration in QuickBooks. The “XXXXX” represents a specific error code number that helps identify the exact nature of the problem.

Are there any specific error codes within the 00000 XXXXX range related to payroll taxes?

Yes! Some specific error codes within the 00000 XXXXX range that can be related to payroll taxes include QuickBooks Error Code 00000 14775, QB Error Code 00000 15204, or QB Error 00000 40477.

How can I ensure the accuracy of payroll setup to avoid encountering QuickBooks Error Codes 00000 XXXXX?

Perform the following steps:

1. Verify the payroll settings.

2. Update the payroll to the latest release.

3. Perform payroll reconciliations.

4. Test the calculations of the payroll.

5. Review the payroll reports.

How can the QuickBooks users fix Payroll Service Server Error?

Following are the steps to resolve the Payroll Service Server Error:

1. Firstly, the user has to restart the system.

2. Next, the user has to go to the Command Prompt.

3. The user has to end DNS.

4. After that, the temporary files are needed to be deleted.

5. Then, the user has to carry on with the second step.

6. At last, the user has to try dispatching the payroll.

When are unrecoverable errors witnessed in QuickBooks?

Unrecoverable errors are those errors which are witnessed if in case some kind of network connectivity issues occur. These errors occur upon missing windows updates or damage in the data.

Winding up!

Hopefully, the above provide steps to resolve or troubleshoot the QuickBooks payroll setup error code (00000 XXXXX) are quite easy for the users to implement. These tips are provided by the professionals and are easy to go. Incase if you find any difficulty in any step or have queries regarding anything related to QuickBooks, feel free to contact our technical team at QuickBooks payroll technical support. Call us at our helpline 1-800-761-1787.

More helpful articles:

How to Fix QuickBooks Error Code 6189 and 816?

Methods to Fix QuickBooks Desktop error 403

How to deal with QuickBooks Error 17337?