Noticed an unexpected backup error and can’t find an ideal fix for that? Well, QuickBooks backup errors can be a bit confusing and needs to rectified immediately. One such error that we will be addressing in this piece of writing is QuickBooks backup error 248. You can often end up in QuickBooks backup error after rebuilding the data in QuickBooks verify/rebuild results. You can come across the following warning message:

QuickBooks found some problems with your company file

But don’t worry! Tackling through this error becomes super easy , once you try rebuilding your company file. Another scenario when such an error shows up can be when the company data is corrupted. To rectify all this, there are a couple of solutions that you can implement. In this segment, we have tried to provide you the real time solutions to QuickBooks error 248. To understand this better, let us scroll through this piece of writing carefully. Getting rid of QuickBooks backup error 248 surely needs some effective solutions, and below we have tried to jot down some of the most effective ones. Let us get into the details:

Table of Contents

ToggleSolution 1: Run QuickBooks Rebuild Data Utility

Running rebuild data utility can surely be an effective fix to the backup issues. You need to run the Verify and Rebuild tool in order to fix such data errors. It is an important tool that fixes multiple issues in the company file. The steps to use the tool are:

Step 1: Run the Rebuild Tool

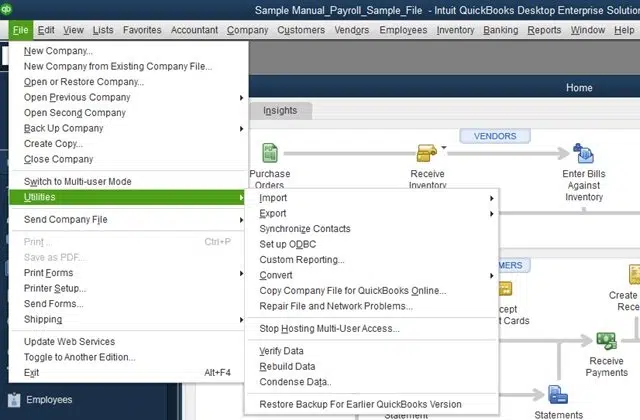

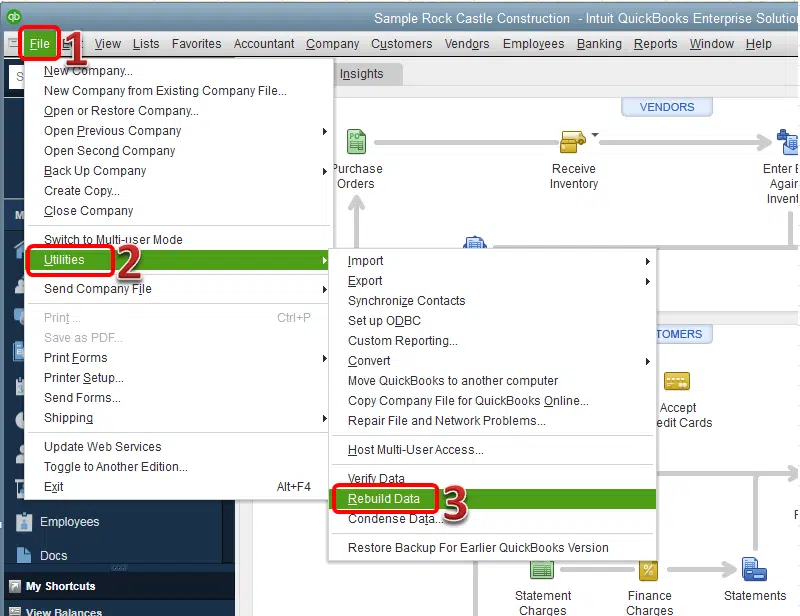

- Under this process you need to simply open QuickBooks desktop.

- After that, you need to head to the file tab.

- Choose the utilities tab.

- Furthermore, click on rebuild data and then carry out the prompt to save a backup of the company file.

- You now have to wait for QuickBooks to complete the backup process.

- The last step in this solution is to click on the ok tab and when the message Rebuild has completed shows up on the screen.

Step 2: Run the Verify Data Tool

This step requires you to run verify data tool using the steps below shared below:

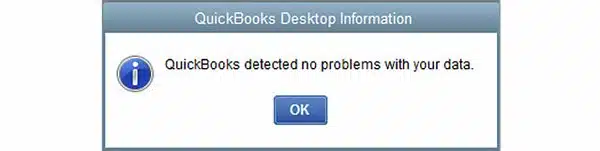

- Here you simply have to head to the utilities tab under the file tab.

- Choose verify data.

- Now, you need to click on the ok tab, in case you get the message QuickBooks detected no problem with your data.

- Just in case the verify data tool finds out any issue with the company file, then you need to click on Rebuild now.

- And towards the end, you need to click on close.

Important: Note that, in case you are running the QuickBooks rebuild data tool brings up an error message: Type: paycheck, Paycheck: Txn # 30159 on 15/06/2019, doc#:’8000, PO#:”, last edited by,” Source, accnt: <bank name>, $:-200.20, name:<name>” then you simply have to edit the company file manually.

Solution 2: Create an additional item to reimburse the payment

Another solution that can work in this case can be creating an additional item to reimburse the payment with the help of the steps shared below:

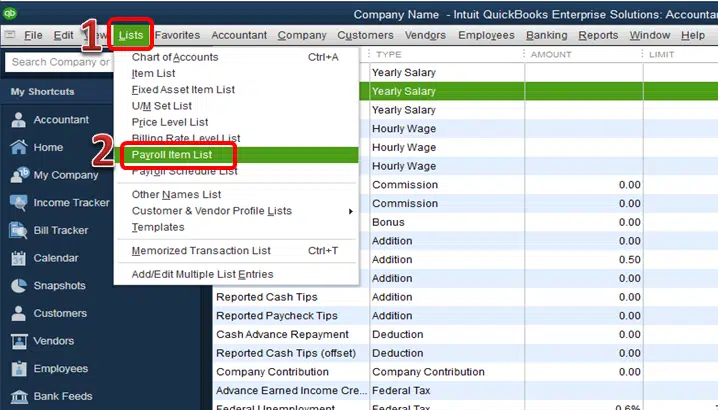

- You need to first open QuickBooks.

- Proceed to the list section.

- After that go for the Payroll List Option.

- And then, opt for the custom setup option.

- Hit a click on the next tab.

- Followed by, assigning a name to the new item.

- You will then have to choose the appropriate account to link the item.

- Followed by selecting none for the tax tracking type option and then click on next twice.

- The next step is to click on neither and then hit the next tab.

- Lastly, enter the amount that is overpaid, and towards the end click on the finish tab.

Solution 3: Configure Employee Info

There aren’t much solutions to this error. One last solution that you can try in this case is to configure the employee information. This can be done with the steps below:

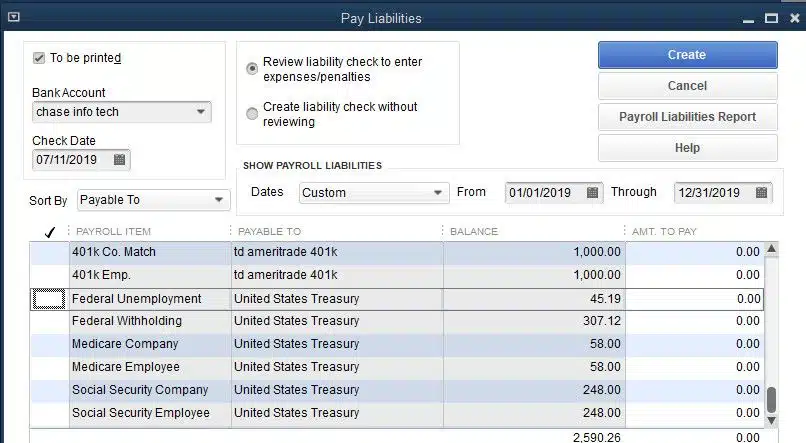

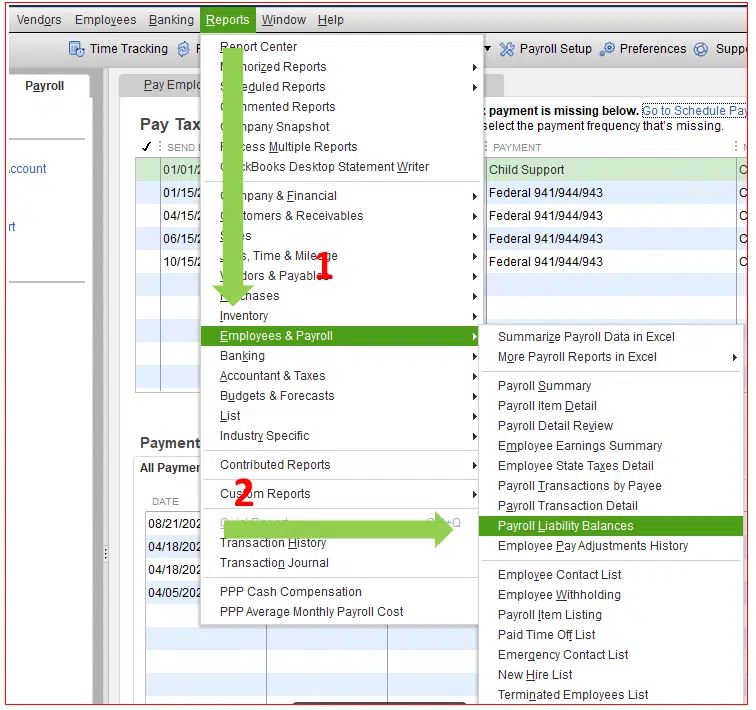

- To begin with, you need to choose payroll taxes and liabilities from the employee menu.

- Heading forward, you need to enter the date and effective date after opting for adjusting payroll liabilities.

- You need to choose employee and employee’s name in the adjustment section.

- And lastly, under taxes and liabilities, go for the payroll item you need to adjust and further enter a negative value to reduce it.

- Also, click on the ok tab to save it.

Winding up!

Troubleshooting errors in QuickBooks isn’t that tricky. However, it is essential that you implement the right steps. Here in this segment we have tried to summarize the essential steps that can be performed to permanently fix QuickBooks error 248. However, if your queries aren’t addressed yet, then reaching out to our QuickBooks error support professionals at +1-800-761-1787 is something we suggest. Hopefully, our certified ProAdvisors will find a way out of this error and help you get rid of it permanently.

FAQ’s

What is QuickBooks Error 248?

As we mentioned earlier, QuickBooks backup error 248 is an error associated to the issues in the backup and payroll processes, and it generally comes up in the form of the following message:

Warning: QuickBooks found some problems with your company file, but don’t worry! You can fix most issues by rebuilding your company file (File/Utilities/Rebuild Data).

If this error isn’t dealt with on time, it can pose a threat to the accounting data, involving loss of data and payroll related issues.

What are the causes of QuickBooks Backup Error Message 248?

Identifying the actual causes of the backup error 248 becomes essential to fix the error permanently. Let us check out the basic factors causing this backup error.

1. In case your employee may have overpaid, then experiencing such an error can be quite possible.

2. Or if the company file is showing some sort of corruption issues.

3. You can later on end up in such an error if there are some sort of payroll Item related issues present.

Related Errors: