Want to learn some easy steps to zero out payroll liabilities in QuickBooks? Your payroll liabilities balance report carries certain information that relates to the payroll items allocated to the deductions, liability account, and others. In certain scenarios, you are supposed to zero out your payroll liabilities in QuickBooks, such as when the report shows a wrong account. Not just that, but as we all know that the liabilities are something that you need to pay, and once you have a paid a liability, it becomes crucial to zero it out, to ensure that your accounts stay valid. To help you understand the process to zero out payroll liabilities in QuickBooks, here we are with this piece of writing. Let us together understand the concept of payroll liabilities.

Table of Contents

ToggleWhat is a payroll liability?

Just like other liabilities, payroll liabilities are the amount that you are supposed to pay, as they are the amount that you owe to your employees. It can be the payroll tax that you have held back from the employees. Here are a few examples showing payroll liabilities:

- Health insurance contributions

- Union dues

- 401(K) contributions

What is the necessity to zero out Payroll Liabilities in QuickBooks?

The major factors that necessitate zeroing of payroll liabilities in QuickBooks are given below:

- You might need to zero out liabilities if the workers are no longer receiving checks.

- When you plan to make adjustments to the Health Savings Account covered by the commitments of the company to its employees.

- Zeroing out is also important when the employee compensation equals the net estimated compensation.

You may also like: How to Export and Convert QuickBooks Online Data Files to Desktop?

Quick Steps to Zero Out Payroll Liabilities in QuickBooks

Here are the steps that you need to follow in order to zero out your payroll Liabilities in QuickBooks.

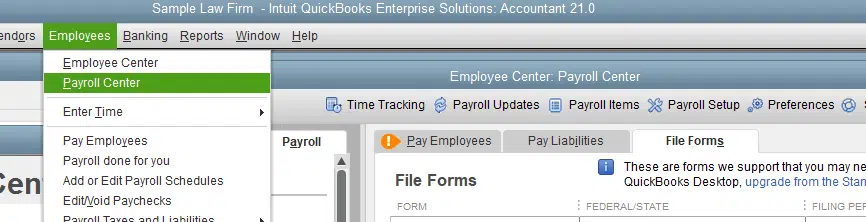

Step 1: You simply have to first open your QuickBooks Account.

Step 2: Furthermore, head to the Employees and choose Payroll center.

Step 3: You are then supposed to add a checkmark against the Payroll liability that the particular payment was made for.

Step 4: Once don with that, you need to choose the View tab or the Pay tab. This will show up the liability check-up for you.

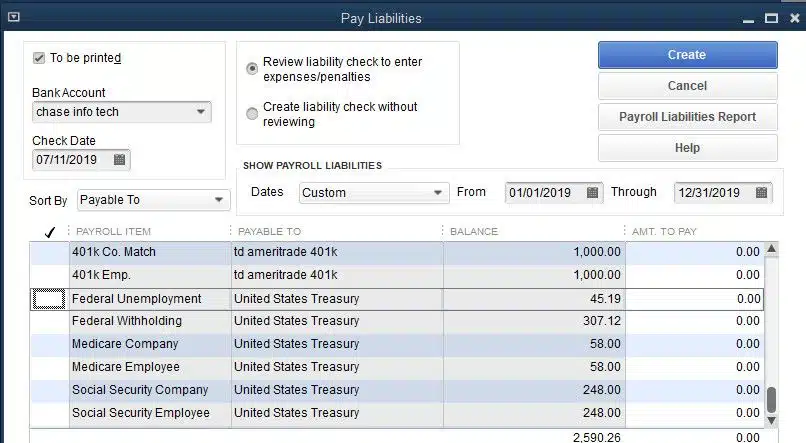

Step 5: You now have to choose the Expense and then head to the Account drop-down menu.

Step 6: In this step, you need to choose the Expense account that you opted for when the payment was recorded.

Step 7: The next step is to head to the Particular amount section and choose the Negative value sum that is same as the liability value.

Step 8: Go for the Recalculate option which will turn the payroll liabilities to zero.

Step 9: You are now required to hit Save and Close to complete the process.

Alterations to be done by the Company

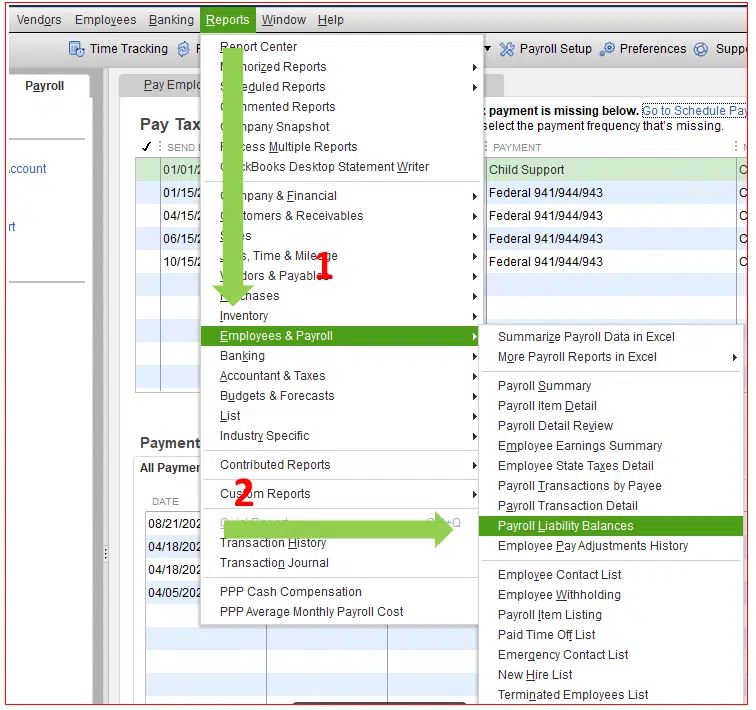

- To start off, you need to open QuickBooks.

- After that, click on Employees tab.

- You then need to select the Payroll Taxes and Liabilities option.

- Go ahead with the opt to modify payroll taxes and liabilities.

- You are supposed to choose Adjust Payroll Liabilities option.

- Also, select correct modification date.

- Now, select the Company from the Adjustment option.

- Then click on Edit option from Item name drop-down.

- Enter the negative value sum.

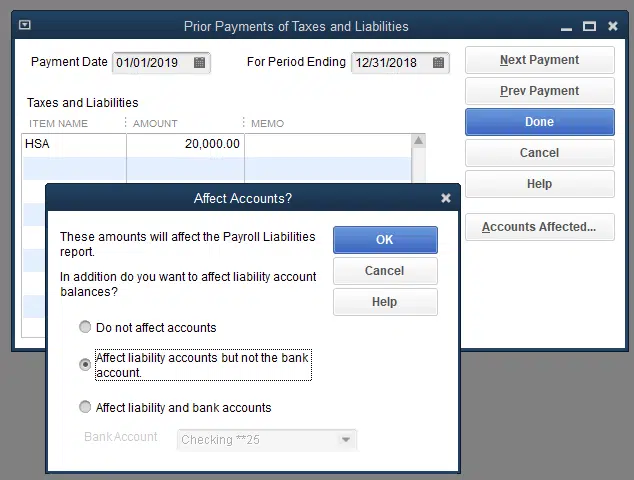

- Choose Affected Accounts option and select affect Accounts for Liabilities and Expenses.

- Also, make sure to click on Not Affect Accounts.

- Lastly, click on Ok.

Alterations to be done by the Employee

- Select an Employee from the Adjustment for Fragment list.

- Now select Employees whose names you want to change.

- Make sure the payroll item must be selected from the Taxes and Liabilities section, and the negative amount needs to be entered.

- Follow the on-screen directions for modifying the company plan in order to save the changes.

Steps to pay payroll liabilities in QuickBooks Online

You are supposed to select the right section in order to record the payment, especially when you use QuickBooks Online to pay your payroll liabilities. You need to first sign in your QuickBooks dashboard. And then continue with the steps ahead:

- To start off with, simply head to the Payroll tax center and then choose Taxes from the left hand tab.

- You will see two tabs, one is for the Sales tax whereas the other is for Payroll tax. You need to go for the Payroll tax.

- Now, head to the Tax you wish to pay from the tax type column.

You might see different options depending upon the geographic location that is registered for payment. In case you aren’t, then you can submit and pay using a government website.

In certain scenarios, you might come across some errors while reconciling payroll liabilities in QuickBooks, which can be due to employee received more than the original payment amount. Or if the error shows file cannot be installed, or few other scenarios. In that case, you will have to connect with some professional for better assistance.

Read Also: Steps to Setup/Configure Email Services in QuickBooks Desktop

Conclusion!

In order to Zero Out payroll liabilities in QuickBooks, the above steps and solutions might work wonders. If still you have some doubts and confusions, then you can ring up to our QuickBooks payroll customer support team at +1-800-761-1787, and they will surely clear all your clouds of confusion. Our QuickBooks ProAdvisors are dedicatedly providing professional assistance to all users round the clock. For more information, give us a call today!

FAQs

Why do I have payroll liabilities in QuickBooks?

Payroll liabilities in QuickBooks remain due to unpaid wages or any amount which has been withheld from payroll.

How do I Create employer liability categories in QuickBooks?

The procedure to create employer liability categories in QB is:

1. Go to Payroll > Payroll Settings tab.

2. Now, go with the Pay Run Settings, then Pay Categories, followed by Add.

3. Provide a name to the category, and then click on Save.

4. Associate an external ID for this is optional category.

What is the difference between payroll liabilities and payroll expenses in QuickBooks?

Payroll expenses include costs for running a business, while Payroll liabilities include costs that the employer pays for hiring new workers.

More helpful topics:

How to Correct the Incorrect COGS in QuickBooks Desktop?

Steps Add a User License to Your QuickBooks Software

How to Export Lists from the Old Company File into a New Data File?