Want to update your state unemployment insurance rate? Well, talking about the SUI rate, your state sets the same and it is unique to your business. In case you are a new employer, then your state will assign you a new employer rate till the time you file unemployment taxes of a certain period of time. In order to update your State Unemployment Insurance Rate in your QuickBooks online payroll or QuickBooks desktop payroll, then reading this informative article till the end will definitely work.

Table of Contents

ToggleWhy you need to update State Unemployment Insurance?

Each time the SUI rate changes, you will have to update it in your payroll, simply to keep the SUI tax liability accurate. It should be noted that, state unemployment insurance is only paid by the employer, unless the state is AK, NJ, or PA that needs the employees to contribute. Usually, the state sends out the accurate and updated rate notices towards the end of the year, or even at the beginning of the new year. After you have received your SUI rate, you simply have to update it by performing the right steps.

You may also see: How to Resolve QuickBooks Error Code 557?

Steps to Update State Unemployment Insurance SUI Rate in QuickBooks

The steps to update SUI rate in QuickBooks vary for QuickBooks online payroll and QuickBooks desktop payroll. Thus, make sure that you apply the steps accordingly. Steps to update state unemployment are as follows:

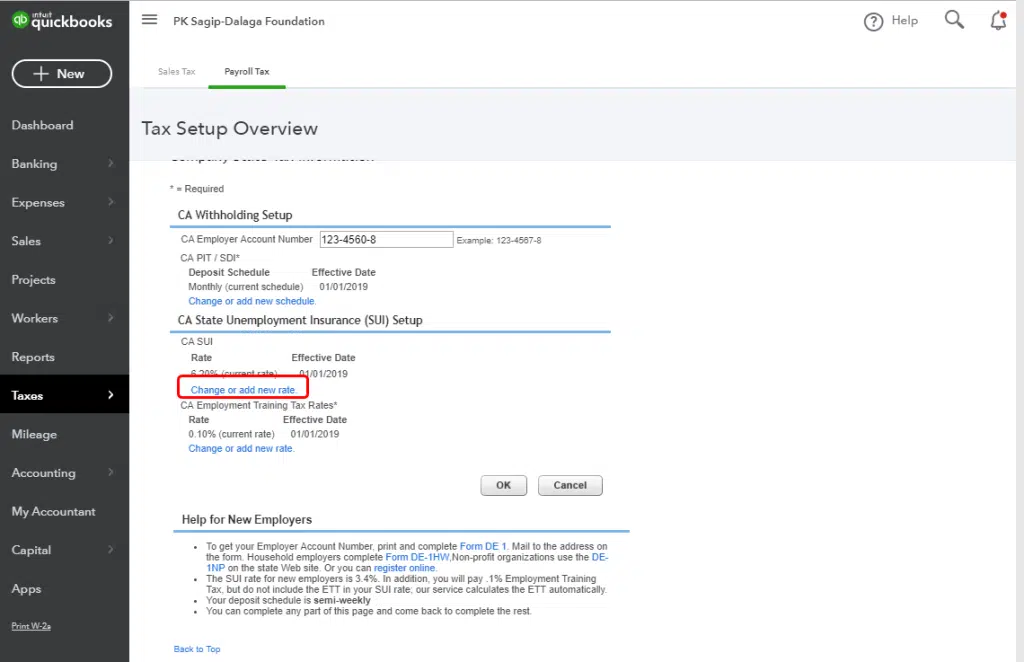

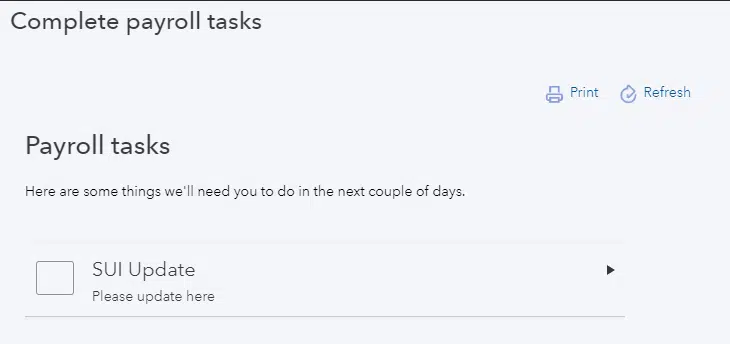

QuickBooks Online Payroll

- To begin with, you will have to sign in to QuickBooks online.

- Furthermore, you need to proceed with the Settings tab.

- Go for the Payroll settings.

- And also choose Edit for the state you want to update.

- The next step is to select Change or add new rate in the state unemployment insurance setup section.

- You will further have to Enter your new rate and its effective date.

- For majority of the state the effective tends to be 1/1.

- And then, for TN, VT, and NJ the date is 7/1.

- In case you can’t change the current year’s rate, then you will have to Send notice to Intuit and they will update the rate for you.

- The next step is to choose or enter any updated surcharge or assessment rates.

- The last step here is to choose Save and OK tab and you are done.

QuickBooks Desktop Payroll

Just in case you are a QuickBooks desktop payroll user, then your SUI rate isn’t part of the normal tax table updates, and so you will have to update it manually.

- Here you need to head to Lists menu.

- Furthermore, choose Payroll item list.

- After that, double click the Unemployment company ‘’[state abbreviation] -Unemployment Company’’.

- And choose Next tab till you reach the Company tax rates window.

- Followed by entering the correct rates for each quarter.

- The last step here is to choose Next and then go for the Finish.

In case you have surcharges or assessments

If that is the case, then you will have to update additional rates in your QuickBooks software. The steps to be performed here are:

- Head to the Lists menu at first, and then proceed to Payroll item list.

- You now have to double click the State surcharge item.

- Once done with that, choose Next tab and perform the onscreen prompts.

- Now, on the Company tax rate page, you will have to manually enter the rate as percentage.

Check Also: How to Prepare and File Federal 1099s with QuickBooks Desktop?

How to Update your Unemployment Rate in QuickBooks Online Full Service Payroll?

To update SUI in QuickBooks Online Full Service Payroll, you should directly connect with our QuickBooks experts and know the easy procedure for the same.

Relationship between FUTA and SUI

There is a certain relationship between the State Unemployment Insurance (SUI) and Federal Unemployment Tax Act (FUTA). It should be noted that the FUTA tax rate is 6%. However, organizations can also go for a 0.6% rate if they successfully pay their SUI taxes on time. Furthermore, the company should not be in a Credit Reduction State.

Conclusion!

Following the steps shared above will definitely help you in successfully updating state unemployment insurance rate in QuickBooks. However, for your assistance the 24/7 QuickBooks desktop support team is available at 1-800-761-1787, and you can directly connect with the experts in case of any queries. Our ProAdvisors will ensure to provide you with the right solutions to all your QuickBooks queries.

Frequently Asked Questions (FAQs)

What is SUI in the US payroll?

SUI is the symbol of State Unemployment Insurance, a tax program by employers for offering distinct benefits to their workers.

Is SUI an expense?

SUI rates form part and parcel of the payroll taxes that the employer is required to pay to the employees who have suffered a recent layoff or have been fired from the company due to other reasons, except misconduct.

What category is SUI?

SUI deduction from the paycheck is made to siphon the funds to the state with a pursuit to support workers out of their jobs.

Other helpful topics:

Methods to Tackle Crash Com Error in QuickBooks Desktop

How to Fix QuickBooks Error Code 6143?

Steps to Host your QuickBooks Company Data in Multi-user Mode