Learn how you can repair QuickBooks Payroll Error PS058 like a pro:

QuickBooks bookkeeping and accounting software comes with multiple features and benefits for mid and small-sized businesses. A few feasible features are:

- Quick and straightforward business management

- Easy tracking of sales, employees, and clients

- Easy management and reports tracking and management

- Preparing taxes

- And more…

But despite being one of the most advanced accounting tools available in the market, QuickBooks, like any other software, isn’t completely free from technical errors and glitches. Therefore, through this article, we are going to discuss one of the most common error – QuickBooks Error PS058. This error may occur due to a system glitch as well as a human mistake. So let’s go ahead and learn about all the possible causes and solutions of this error.

Table of Contents

ToggleWhen does QuickBooks Payroll Error PS058 occur?

This QuickBooks error code PS058 appears on your computer’s screen when you download a payroll update. Generally, the error occurs when the update, download or installation fails.

What causes QuickBooks payroll error PS058?

One or more of the following may trigger this QuickBooks payroll error PS058:

- Windows Explorer files in your computer are corrupt.

- Your QuickBooks company files are damaged/ corrupt.

- Your system firewall or some other security software is preventing access to QuickBooks accounting software.

- The local drive doesn’t have your company file.

You may also like: QuickBooks Error Code 6000 : What Is It And How Do You Fix It?

How To Troubleshoot QuickBooks Error Code PS058?

Further in this post, we will discuss some of the most reliable troubleshooting steps that are already tested by some of the most efficient experts. Try these to fix QuickBooks Payroll Error PS058:

Method 1: Re-download payroll updates

The first troubleshooting approach requires users to re-download the payroll updates. The steps for the same are given as under:

- Firstly, go to payroll server and download the payroll update again.

- After that, navigate to the help menu, select employees and click on Get Payroll Updates.

- Now check the Download Entire Update checkbox.

- And lastly, select Download latest updates.

Method 2: Check and download the latest upgrade release from Intuit’s official website

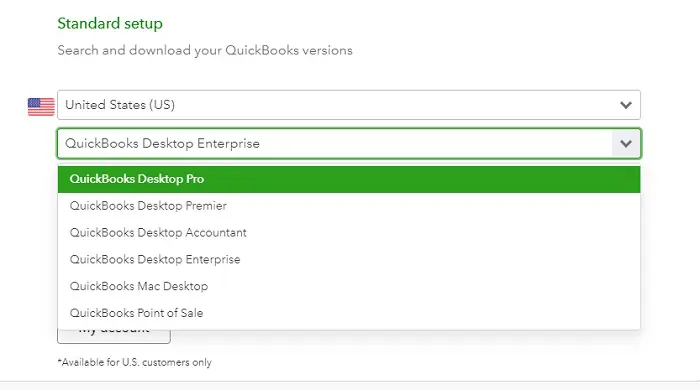

- If you know your QuickBooks version, then go to Intuit’s official website and download the latest QuickBooks updates.

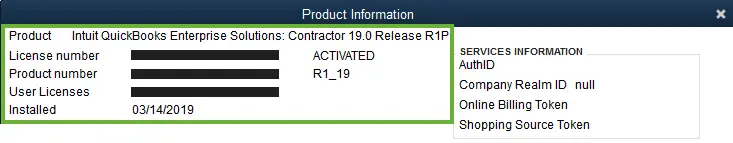

- If you don’t know your QB version, open QuickBooks and press the F2 key on your keyboard and look at the product line on the product information Window.

- Find the version of QuickBooks and the latest QuickBooks updates from Intuit’s website.

Also Read: How to Troubleshoot the WDDM Service Not Running in QuickBooks Error?

Method 3: Download the latest QuickBooks updates online

To perform this step, you must have good internet connectivity.

- Download qbwebpatch.exe patch file from the support page of QuickBooks website.

- Save the downloaded file on the computer that has QuickBooks on it.

- Complete the installation of the patch file and then update the tax file from CD/Flash Drive.

Method 4: Check if the company file has any issue

At times, this error may also be caused due to some company file-related issues. The procedure below should help you check if the company file has any technical errors.

- At first, open your QuickBooks and Press Ctrl+1 or F2 keys on the keyboard and open Product Information.

- On the product info Window, press Ctrl+2 or F3 keys.

- Open Tech Help Window and click on Open File.

- Find file named qbwin.log and double-click on that.

- Press Ctrl + F keys and open the Search box.

- Type in Error in the box and press Enter key.

- Check the error code you receive and perform appropriate troubleshooting steps.

- If you find no errors, move on to the next step.

Similar Post: Methods to fix QuickBooks error code 15223

Method 5: Use RegCure and follow the provided steps

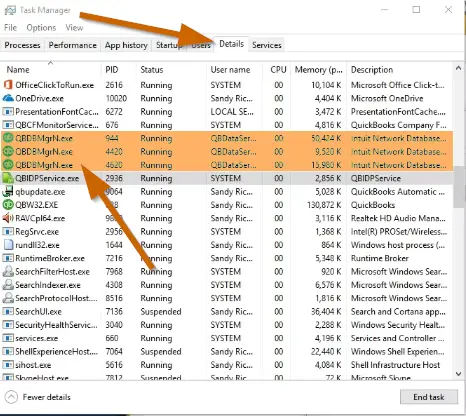

- Open Task Manager (press ctrl+alt+del keys) Find qbupdate.exe and qbdagent.exe in the program list.

- If you find them, close them.

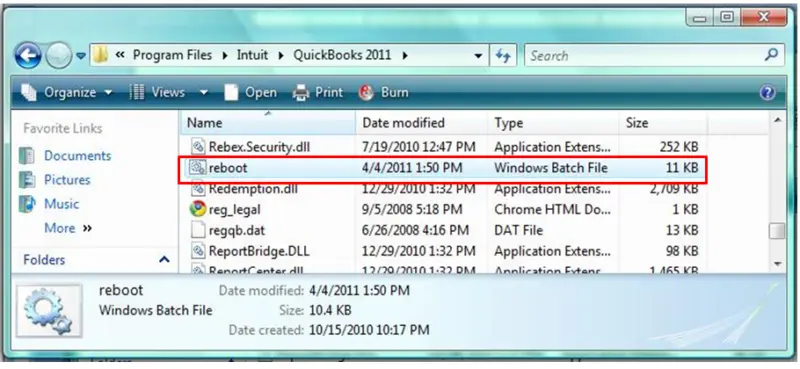

- Now type reboot.bat in the research Window.

- Double-click on the file and the DOS type shell will open.

- Wait for it to get closed on its own.

- Restart your computer and download payroll updates.

Method 6: Run reboot.bat file

- At first, open the task manager (ctrl+alt+del) keys.

- After that hit a click on the Processes tab and find QuickBooks and processes related to it.

- Now End all programs one by one.

- Press the Start button on the keyboard or on the screen, and in the search field, type reboot.bat.

- Press Enter key.

- Run the file and let the process take its time.

- Close it after the process is over.

- Restart your computer and try to download the latest payroll tax.

See Also: How to Write Off an Invoice in QuickBooks desktop?

Final Words..!

In most cases, solutions, as mentioned above, will help you fix this QuickBooks payroll update error PS058. If the issue persists or occurs again, you can call us and speak to our QuickBooks payroll support team at 1-800-761-1787 for an instant solution to this error.

FAQs

What is QuickBooks Payroll Error PS058?

Payroll Error PS058 occurs in case of technical issues related to the QuickBooks Payroll update process.

Can a corrupted QuickBooks company file cause Payroll Error PS058?

QuickBooks Payroll Error PS058 in QuickBooks is typically indicative of issues related to the payroll update process and does not depict corruption in the company file.

Can a third-party antivirus or security software cause Payroll Error PS058?

Yes! Certain third-party antivirus or security software can interfere with the QuickBooks Payroll update process and lead to Payroll Error PS058.

Other Interesting Reads

How to Fix QuickBooks Error Code 15270?