Last updated on February 4th, 2026

Learn the DIY steps to correct or amend previously filed federal forms 941 and 940 in QuickBooks payroll:

Oops! Did you just make a mistake on your federal tax return? That definitely has to be fixed immediately. Or just want to correct important tax entries? This is surely possible by filing an amended tax form for both Federal 941 and 940. This is possible because QuickBooks enhanced desktop payroll lets you file an amended tax return. In case you have QuickBooks payroll assisted, then Intuit helps you file taxes and pay.

Filing a corrected federal form 941 and 940 in QuickBooks desktop payroll involves a bunch of steps, which we will be elaborating in this segment. Make sure to abide by the steps enumerated in this segment for better results.

You may like to read: How to Configure Email Services in QuickBooks Desktop?

Table of Contents

ToggleSteps to File a Corrected Federal Form 941 and 940 in QuickBooks Desktop Payroll

If you need to file a corrected Form 941 or 940 in QuickBooks payroll for your business, you can do so in QuickBooks Desktop Payroll. Here are the steps to file a corrected federal form 941 and 940 in QuickBooks payroll:

Step 1: Find out what form to use

You need to file an amendment form at the very moment when you find any sort of error on a previously filed federal form. This can be fixed by filing the following forms:

- Form 941-X in the case of federal form 941

- For federal form 940, there is no X form. You will have to use the same federal form 940 from the year it was originally filed.

Step 2: Understand the amendment forms

What can be corrected:

Form 941-X – You can use this to correct the following

- Wages, tips, and other compensation

- Income tax withheld from wages, tips, and other compensation

- You can also correct taxable Social Security wages

- Taxable social security tips

- Taxable Medicare wages and tips

- Taxable Social Security tips

- You can check page 5 of the Form 941-X instructions.

Note: There is a due date to file the form, which entirely depends upon when you discovered the issue and if you underreported or overreported the tax.

Form 940 – When to use

You can use the same federal Form 940 from the same year it was filed. And furthermore, check the amended return box present in form 940, page 1, box a. Fill in the amounts that were supposed to be on the original form.

Check Also: How to Resolve QuickBooks Error Code 6106, 1069?

Step 3: Prepare and file the amendment forms

When you file an amendment form, make sure you use a paper return even if you e-filed the original form. Also, ascertain that you enter the necessary liability adjustments before creating an amended return.

Note: You may be required to file your corrected form electronically or by mail depending on your filing method and the type of correction made.

Form 941- X – Prepare form using the steps below

The steps for the preparation and filing of Form 941-X in QuickBooks Desktop Payroll are as follows:

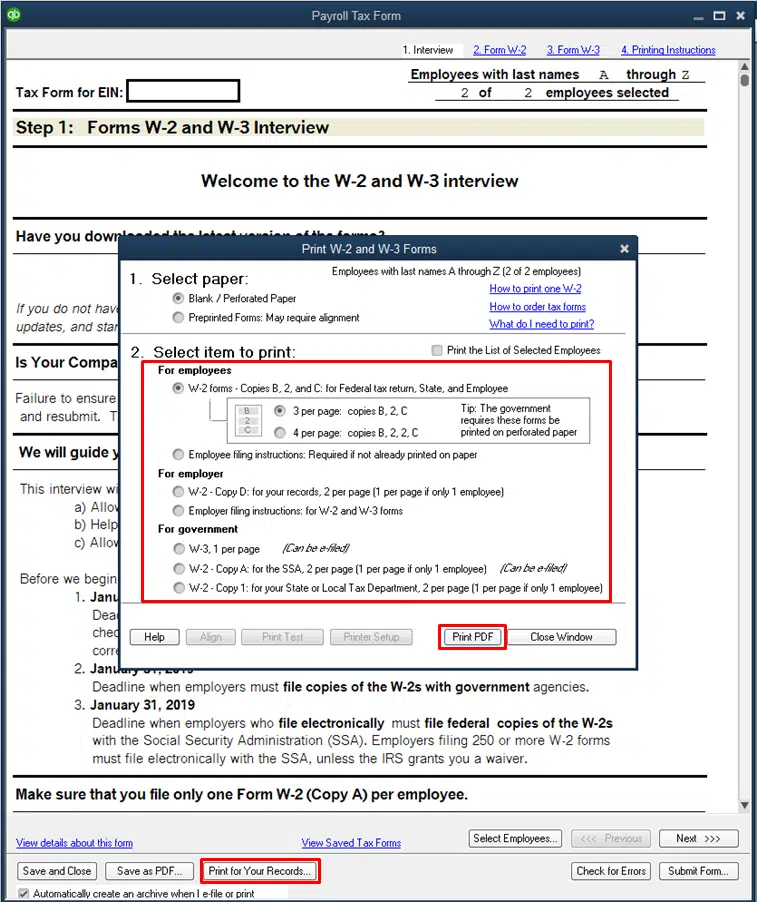

- Here, navigate to the employees tab and further choose payroll tax forms and W-2s.

- You now have to choose process payroll forms.

- The next step is to choose a quarterly form 941-X adjusted employer’s quarterly federal tax return or claim for a refund from the file forms section.

- Now, choose create form.

- And then, go for the filing period you wish to correct and hit ok tab.

- The next step is to choose the return you are fixing and also select the quarter.

- The user will then have to enter the calendar year that is being corrected.

- Once done with that, enter the date you found the errors.

- Choose the process for fixing the employment tax.

- Underreported amounts only.

- Overreported amounts only, using the adjustment process or claim process.

- Combining both under and over-reported amounts on one 941-X.

- You are then required to choose the next tab and also enter the date you discovered the issue.

Under part 1: You need to choose only one process. Ensure that the process is the same as the interview part of the form.

Under part 2: Complete the certification. Ensure that at least one box or select all that apply and hit next.

Under part 3: You need to enter the corrections for the quarter. And if any line doesn’t apply, then leave it blank and hit next. You should check the IRS Instructions in the case of Form 941-X to get any doubts cleared about form filling.

Under part 4: describe each of the corrections in detail. Also, attach any notices if needed.

- The last step is to print and mail the form account to the IRD instructions.

Steps to Amend Form 940

In order to fix the form 940 in QuickBooks, try performing the steps below:

- Start by heading to the employees tab and then choose payroll tax forms and W-2s forms.

- Now, choose process payroll forms.

- And then, select annual form 940/Sch.A- Employer’s Annual Federal Unemployment Tax Return in the file forms section.

- After that, choose create form.

- You are then required to enter the year of the filing period you wish to correct and also click on ok tab.

- Once done with that, you need to choose the amended return box and also choose the next tab.

- After that, review the amounts on page 2 and verify these are the amounts that have to be on the actual form.

- Also, attach the explanation and print as well as sign the form and check out the mailing guidelines.

- You should also provide all the relevant details regarding the reason behind amending the Federal form. That’s it!

Read Also: How to Fix QuickBooks Server Busy Error?

Summing Up!

Towards the end of this segment, we hope that you will be able to File a corrected Federal Form 941 and 940 in QuickBooks Desktop Payroll, even though this can be a bit too technical for many QuickBooks users. However, if you are stuck at any point in time, or need any sort of technical guidance from our Accounting experts, then feel free to ring us up at 1-800-761-1787 and your queries will definitely be answered immediately by our certified QuickBooks payroll technical support experts.

Popular Posts you may Like

How to Re-install QuickBooks for Windows Using Clean Install?

What are the steps to Fix QuickBooks Error code 1606

Steps to Solve QuickBooks Error 1321 When Modifying the File