Are you in search of the right set of steps to get rid of QuickBooks payroll is not taking out taxes problem? If yes, then your search ends with this segment right here. The QuickBooks payroll is not taking out taxes is not a common problem and can be seen due to a couple of factors which are elaborated later in this segment. Get a better brief about this issue by scrolling through the segment carefully.

Table of Contents

ToggleWhy you land into QuickBooks Payroll is not Taking taxes out of Payroll check error?

There can be a couple of factors that can drag you in this sort of issue. These factors include the following:

- One of the primary reasons can be if the gross wages belonging to the employee a per the last payroll are too low.

- Another typical reason causing this problem can be if the payroll tax tables is outdated.

- You can also end up with this issue if the total annual salary of the employee is more than the salary limit.

- Outdated payroll tax tables can also be lead to this issue.

Solutions for QuickBooks Payroll aren’t calculating Payroll taxes problem

Dealing with payroll taxes errors in QuickBooks is easy, as they have a definite set of solutions. Below we have tried to mention the common solutions that you can implement so as to get rid of the issue successfully.

Condition 1: Just in case the year-to-date and quarter-to-date wage or tax information of the employee is incorrect

You can view the taxes of all the active employees in an employee withholding report. This process involves the following set of steps:

- Initially choose Reports.

- Head to the Employees and payroll.

- Hit a click on Employee withholding.

- Tap on Customize Report tab.

- Choose the columns as per your requirements.

- Hit a click on the Items you want to display on your report in the display list section.

- Choose OK tab to Save changes.

- Ascertain if your Employees are set up accurately for state, local, and federal taxes.

- For editing employee info window, ensure to double click the Employee’s name.

- Moreover, the employee information window will appear on the screen.

- Hit a click on Payroll info.

- Tap on Taxes tab.

- Hit a click on Federal, state and/ or other tab.

- Ensure that employee is marked correctly for taxes.

Condition 2: If you have bought a QuickBooks payroll subscription

- In this scenario, you can save the Paycheck of the employee depending upon the calculations you made earlier.

- Change the Check details of the employee for ensuring accurate calculations.

- Manually enter both the Withholding and Employer matches in QuickBooks payroll.

- Just in case you have already subscribed the assisted version of payroll, then you might face issue due to the Payroll taxes being filled by intuit.

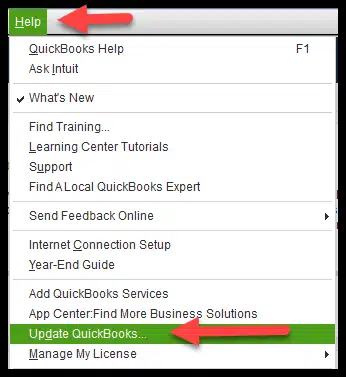

- To chuck off the error, update the QuickBooks software to the latest version.

- This will sync the software with the latest payroll forms and tax tables.

- Before you run the payroll, check if the Employees and Payroll items have been set up correctly.

- Just in case the data within the QuickBooks software is not set up properly, then experiencing the issue is possible.

Read Also: Fix QuickBooks Payroll Update Error (Unable to Send Usage Data)

Condition 3: Check if the annual limit has been set or reached

If a payroll item is not calculating correctly and it stops calculating on a paycheck, there may be a checkmark in the checkbox of an annual limit box and default limit which the employee has reached. You can verify the setup of the item by:

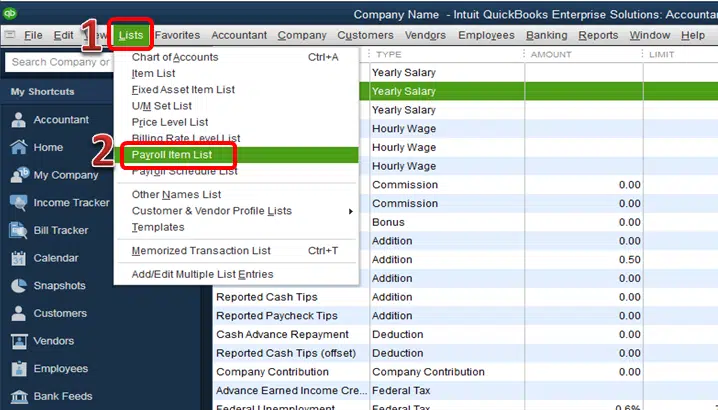

- Select Lists and Payroll Item List from the top menu bar.

- After that right-click on the payroll item that you wish to modify and choose Edit Payroll Items.

- Next, you need to scroll down to the Next screen until you reach the Limit Type screen.

- Now verify that the box at the bottom is correct.

- If the limit is correct, the employee’s payroll should stop calculating at that limit.

- Update the amount if the limit is not correct.

- Next is to do is under Limit Type, Verify that you have chosen the right option.

- Annual – Restart every year

- Monthly – Restart every month

- One-time limit

- You can change the default limit or Limit Type selection to suit your needs.

- End the process by hitting a click on Finish.

Alternative method to correct Payroll taxes in QuickBooks

Method 1:

You need to ensure that the software is in the latest version. And review the employee’s tax setup, as it affects the process of QuickBooks calculating the taxes. After that revert the employee’s paycheck. This would refresh the payroll information to calculate the taxes on the transaction. This can be done using the set of steps below:

- You need to open the Employee’s payroll information.

- Later on, right click the name of the Employee which is highlighted in Yellow color.

- Choose Revert paycheck.

Method 2:

- Aft first, you need to open our QuickBooks,

- Afterwards, Hot a click on Employees.

- From here, you need to select the Get Payroll Updates option.

- Now select the Download entire payroll update radio-button.

- Also choose Update opt.

- You need to wait for the process until the complete update is finish.

Once the above mentioned applied successfully, you can try to run your payroll again for correct taxing.

Wind Up!

The above segment would have helped you in tackling through the QuickBooks Payroll is Not Taking Out Taxes issue successfully. If you still have any issue or need more information about the payroll taxes, then our 24/7 QuickBooks payroll technical support personnel can rescue you from this annoying error. All that is needed is reaching out to our tech geeks right away at 1-800-761-1787, and they will get back to you with immediate solution.

FAQ’s

Why aren’t taxes being taken out of paycheck?

Taxes may not be taken out of a paycheck due to an error in the payroll setup, incorrect employee information, or an exemption claimed on the W-4 form.

How do I fix federal tax withholding in QuickBooks?

To fix federal tax withholding in QuickBooks, go to the employee’s profile, edit the W-4 form, and update the tax withholding information.

Why is payroll not taking taxes out of checks?

Payroll may not be taking taxes out of checks due to incorrect tax setup, outdated software, or incorrect employee information.

Why Quickbooks not withholding payroll taxes?

QuickBooks may not be withholding payroll taxes due to incorrect payroll tax setup, outdated software, or incorrect employee information.

Other helpful posts:

Set up access between QuickBooks Desktop and connected Intuit services

How to Troubleshoot QuickBooks Error Code 15227?

Latest Steps to Print W-2 forms in QuickBooks desktop