Learn the possible ways to fix QuickBooks Error 81594 when trying to efile 1099:

When users try to efile 1099, QB users may stumble upon an error message related to the error code 81594. This error may occur due to various factors, the chief cause being an attempt of the user to re-subscribe QuickBooks Online. However, the system instead detects an incorrect address. The issue can be resolved by updating correct details of the address in the Account and Settings page.

Table of Contents

ToggleWhy QuickBooks error message 81594 occurs when try to efile 1099?

QuickBooks error message 81594 can occur when there is an issue with the communication between the software and the IRS e-file system. This error message specifically pertains to e-filing 1099 forms, which are used to report certain types of income to the IRS. There can be several reasons why this error occurs, including:

- Incorrect information: One of the most common reasons for this error message is that there is incorrect information entered on the 1099 form. This could be due to a typo or an incorrect social security number or tax identification number for the recipient.

- Software issues: Another reason why this error message might occur is due to software issues. This could include outdated software, software that is not compatible with the IRS e-file system, or other software-related issues.

- Internet connectivity issues: If there are problems with your internet connection or firewall settings, you may encounter QuickBooks error message 81594 when trying to e-file your 1099.

- System maintenance: The IRS e-file system may be undergoing maintenance or experiencing high traffic, which can cause errors when attempting to e-file.

- Electronic filing identification number (EFIN) issues: If there are problems with your EFIN, such as an expired or incorrect number, you may encounter this error message.

You may read also: How to Troubleshoot QuickBooks Error Code 6129?

How to Fix error message 81594 in QuickBooks?

Here are some steps you can take to try and resolve the issue:

Method 1: Update correct details related to the Company

The procedure below should help users in fixing the error in the easiest possible way:

- Advance to the Settings.

- After that, go to Account and Settings.

- Click on the Company tab.

- Click on the Address section.

- The users should now update the Company address and details pertaining to the company.

- Once done, click on Save.

- Finally, hit on Done.

Method 2: Login to the account in the Incognito mode

Another effective approach to fix QuickBooks Error 81594 is by accessing the Incognito mode of the browser. Upon logging in to the account in this mode, users should make sure that the company details are correct. Once all is double-checked, try to re-subscribe once again. The Incognito shortcuts for different web browsers are given as under:

- For Google Chrome: Ctrl + Shift + N keys.

- For Microsoft Edge: Ctrl + Shift + P Keys.

- For Firefox: Ctrl + Shift + P Keys

- For Safari: Command + Shift + N keys

Method 3: Clear browser cache

Procedure to clear browser cache in Google Chrome

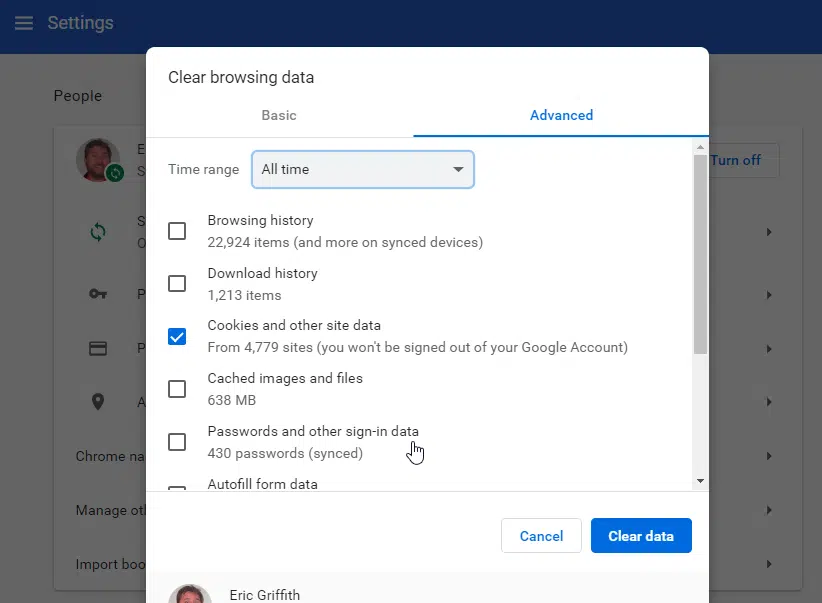

- Run Google Chrome and then click on “More” at the top-right corner.

- Hit on More Tools and then go to the option to Clear browsing data.

- Click on a time range and opt for All time.

- After that hit a click on the check boxes corresponding to Cookies and other site data and Cached images and files.

- After that, click on Clear data option.

- Now, navigate to QuickBooks and login to the account.

- Try to efile 1099 again to check if the error message 81594 got fixed.

Alternatives Steps to Rectify QuickBooks Online Error 81594

To fix QuickBooks error message 81594 when trying to e-file your 1099, you can follow these steps:

- Verify that all the information entered on the 1099 form is correct, including the recipient’s name, address, and tax identification number. Make sure that you have entered the information exactly as it appears on the recipient’s W-9 form.

- Update your QuickBooks software to the latest version, if it’s not already up to date. To do this, go to the Help menu, select Update QuickBooks, and then follow the prompts to download and install any available updates.

- Check your internet connection to ensure that it’s stable and has enough bandwidth to e-file. Try disabling any firewalls or security software temporarily to see if they are blocking the connection.

- If you have recently changed your Electronic Filing Identification Number (EFIN), ensure that it’s updated in QuickBooks. Go to the Company menu, select My Company, and then click the E-File tab to check your EFIN.

- Try e-filing your 1099 at a different time, such as during off-peak hours or on a different day. The IRS e-file system may experience high traffic during certain times, which can cause errors.

- Contact the IRS e-help Desk for assistance if you have exhausted all other options. They can help you troubleshoot the issue and provide guidance on how to resolve it.

- By following these steps, you should be able to fix this error and successfully e-file your 1099.

Summing Up!

In the current blog, we have given brief details about the various methods to fix QuickBooks Error message 81594 when users efile 1099. To get a firm grip over different technical errors encountered in QuickBooks, you can sail through a wide range of FAQs and Articles on our website. If you want to speak to our 24/7 QuickBooks error support experts, then contact us at 1-800-761-1787.

Popular FAQ topics:

What are the Recommended Networks for QuickBooks Desktop?

How to Fix QuickBooks Error Code 1330?

What are the Ways to Fix QuickBooks Unable to Sync License issue?